Quickbooks is an accounting software program that helps small and medium companies carry out monetary operations akin to expense monitoring, reconciliation, and invoicing. Quickbooks imports transaction knowledge from uploaded financial institution statements to carry out monetary operations.

To be able to import transaction knowledge, financial institution statements must be uploaded in Quickbooks supported codecs akin to Quicken (QFX), QuickBooks On-line (QBO), Quickbook Supported CSV, or Microsoft Cash (OFX).

Nevertheless, in case your financial institution statements are in a format not supported by Quickbooks akin to CSV, PDF, or XLSX, you can’t import your transaction knowledge instantly.

You could convert them to Quickbooks supported format in order that they are often uploaded into Quickbooks. Therefore, on this weblog, we’ll take a look at strategies to transform CSV to Quickbooks supported codecs.

How one can Convert CSV to Quickbooks Supported Format

We are going to take a look at strategies that can enable us to import transaction knowledge from financial institution statements in CSV to QBO or Quickbooks supported codecs. Let’s take a look at these two strategies:

Manually changing CSV to QBO utilizing Microsoft Excel/Google Sheets

Google Sheets/ Microsoft Excel don’t enable changing CSV to QBO format. Nevertheless, we are able to simply convert incompatible financial institution statements in CSV format to Quickbook supported CSV format. Here is how you are able to do it:

-

Open a clean google Spreadsheet by clicking here.

-

Import your financial institution assertion to google sheet by clicking on File->Import adopted by importing your financial institution assertion.

-

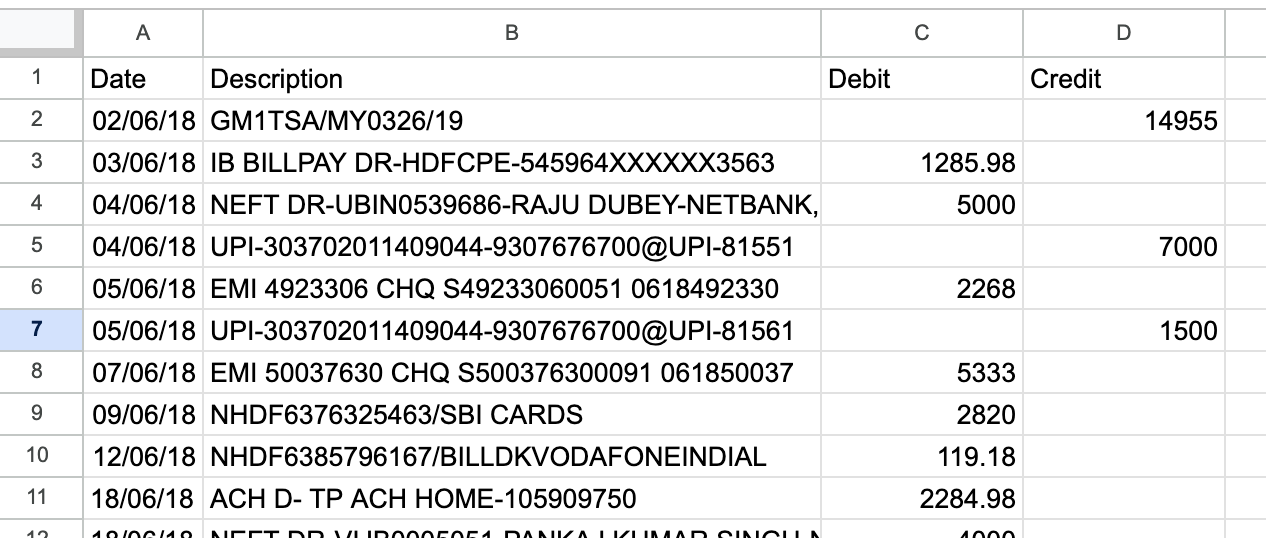

The financial institution assertion appears just like the picture under. Take away all further textual content aside from the financial institution transaction desk.

-

Quickbooks helps CSV in solely two codecs. Therefore, we are going to modify our CSV in one of many codecs. Be sure that the column headers have the identical title.

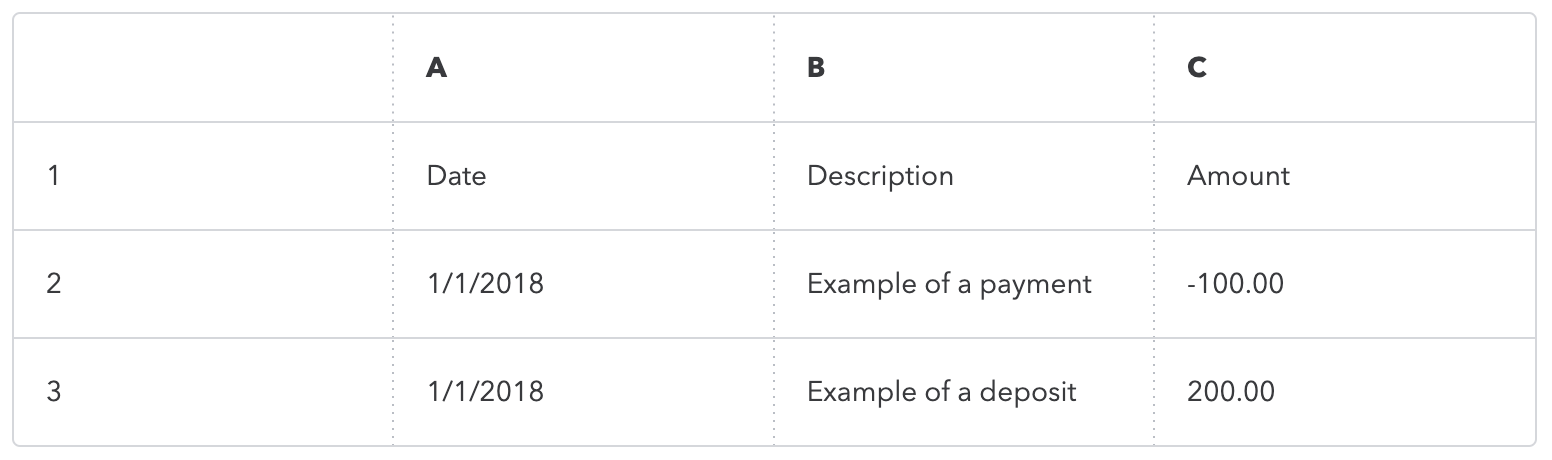

a. Three-column format: This has date, description, and quantity.

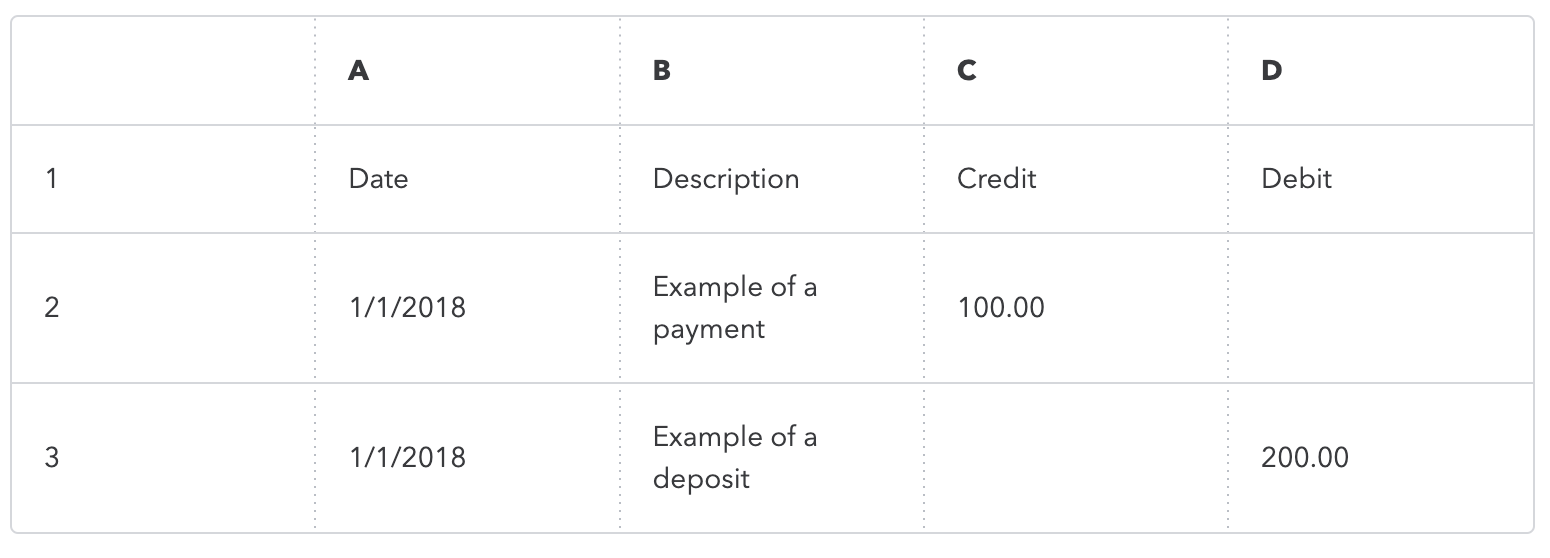

b. 4 Column Format: This has date, description, credit score, and debit.

-

Put up modification, the sheet will seem like this. We now have eliminated further columns and have named the headers in accordance with the QBO format.

-

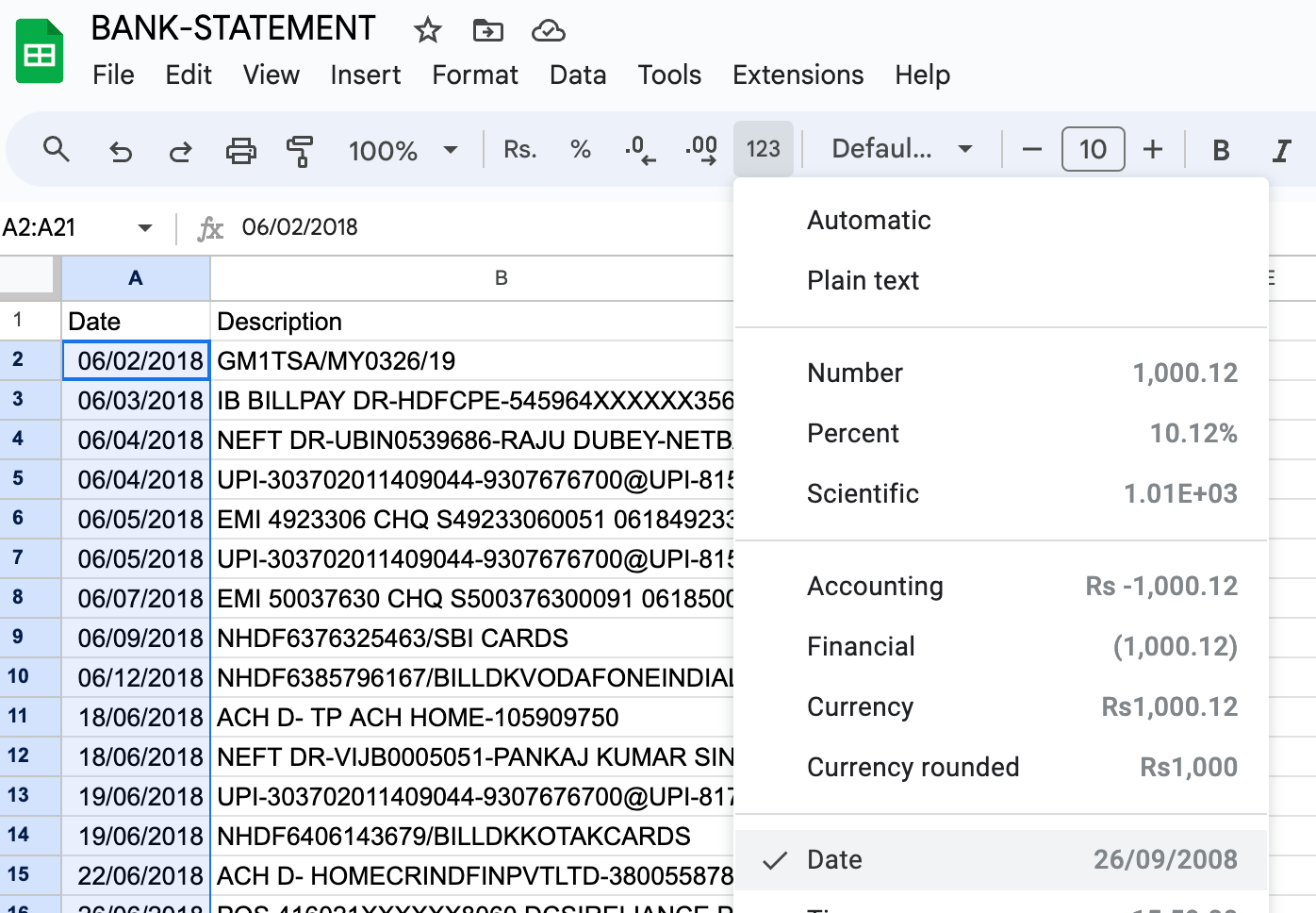

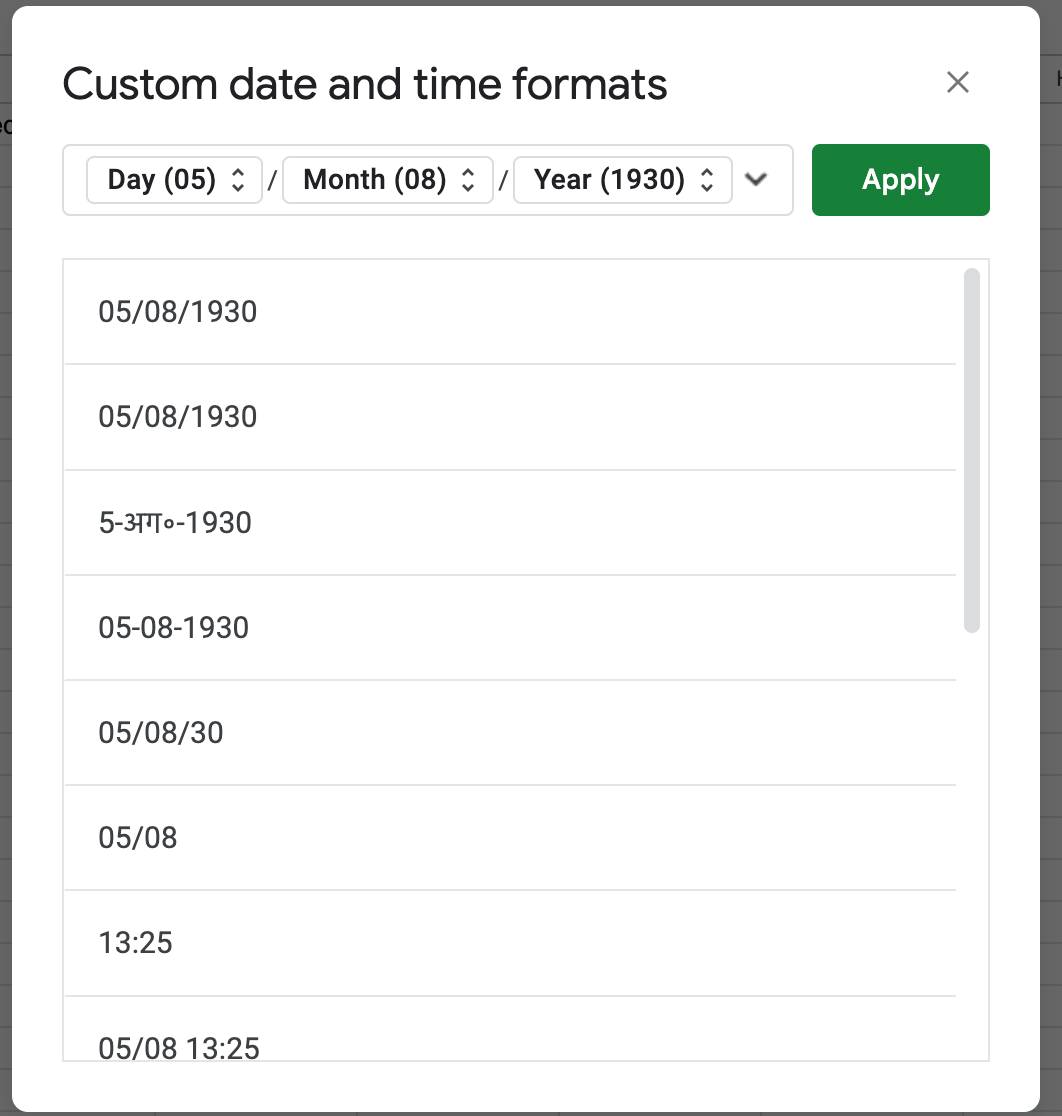

Modify the date column to make sure that it’s in dd/mm/yyyy format. Choose all of the dates and click on on Extra Codecs (123 icon) -> Date dd/mm/yyyy format.

NOTE: If you don’t see this selection explicitly then click on on Extra Codecs (123 icon) -> Customized Date and Time. A window will open. Specify the date format as dd/mm/yyyy and click on on Apply.

-

The financial institution assertion is now appropriately formatted. Obtain it as CSV and add on the Quickbooks platform

-

For those who see an error, be certain that you:

- Take away any zeros (0) from the file. Go away these cells clean.

- Appropriate any transactions that show numbers within the Description column

- Make certain the dates are in one format.

- Some banks add the day of the week within the Date column (for instance, 20/11/2018 TUE). You could take away the day of the week.

Changing CSV to QBO with Nanonets

The above technique is appropriate for one-time use. If it’s good to add recordsdata day by day to Quickbooks, then it’s higher to automate conversion of CSV to QBO with Nanonets. Nanonets can seamlessly extract knowledge from financial institution statements and export it to Quickbooks.

Right here’s methods to convert a financial institution assertion (Quickbooks On-line/Desktop) utilizing Nanonets.

-

Join free on app.nanonets.com. No bank card is required.

-

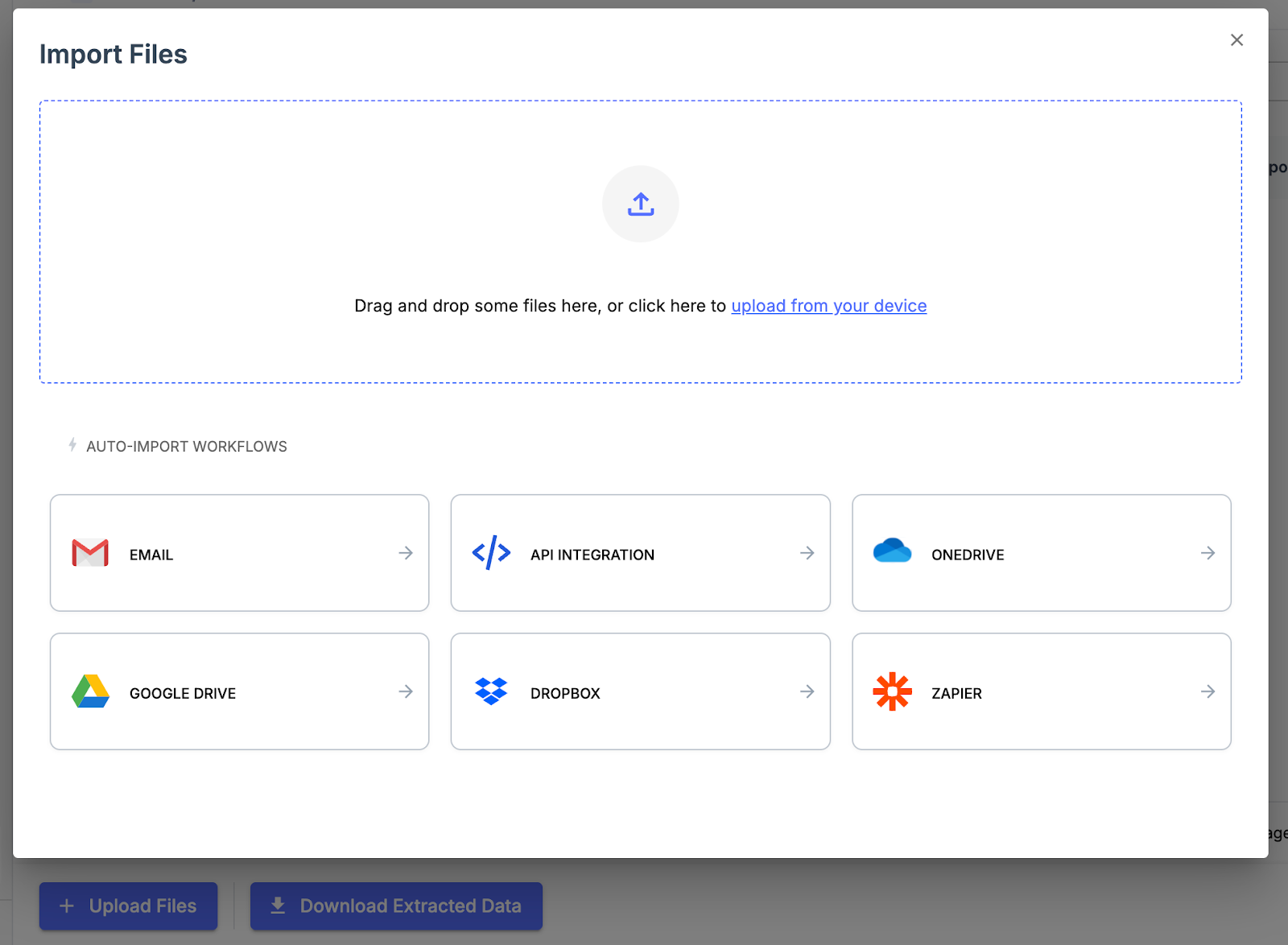

Click on on New Workflow->Financial institution Assertion. Your mannequin shall be created. Click on on Add to add your financial institution assertion (in PDF or XLSX). It’s also possible to arrange auto-forwarding through electronic mail to routinely add your financial institution statements to Nanonets.

-

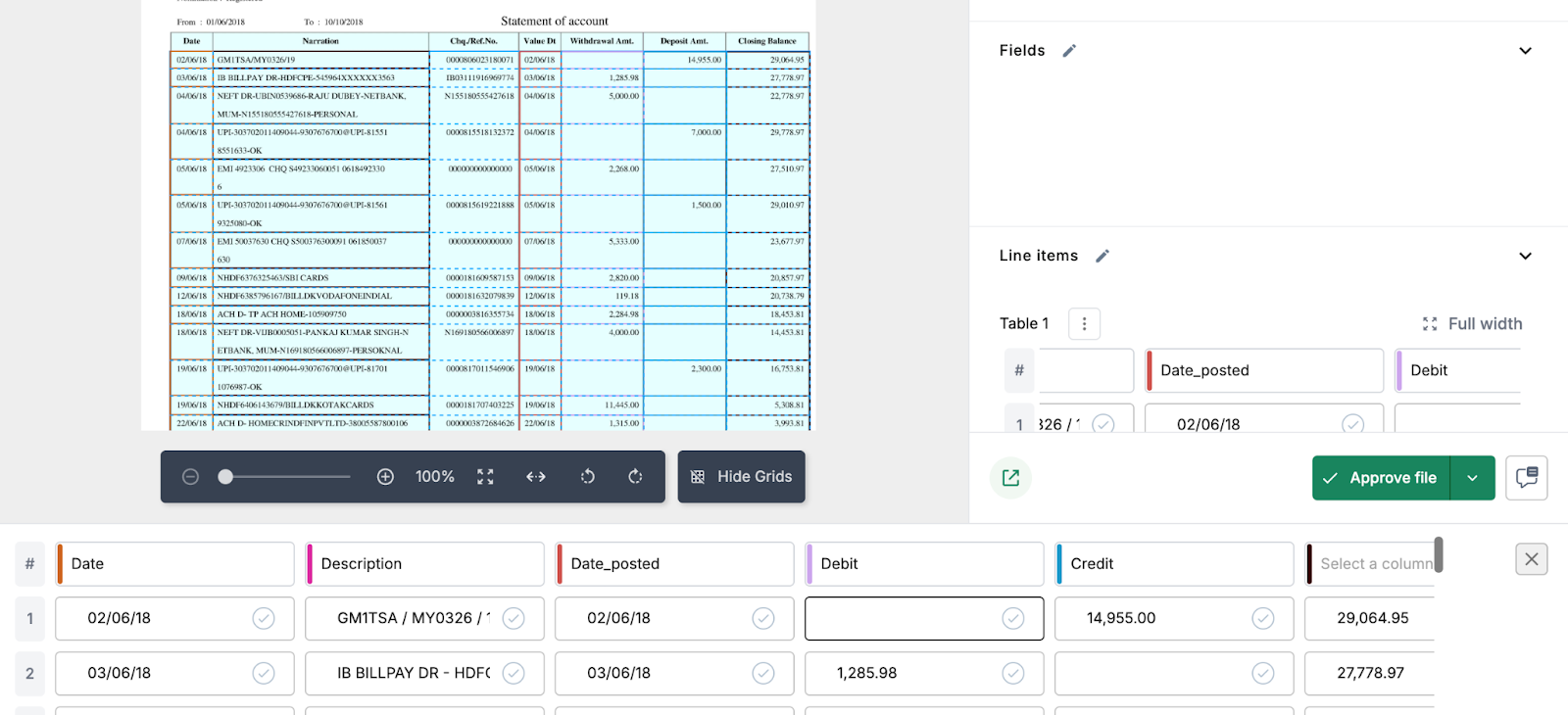

Nanonets’ highly effective OCR extracts the information from financial institution statements.

-

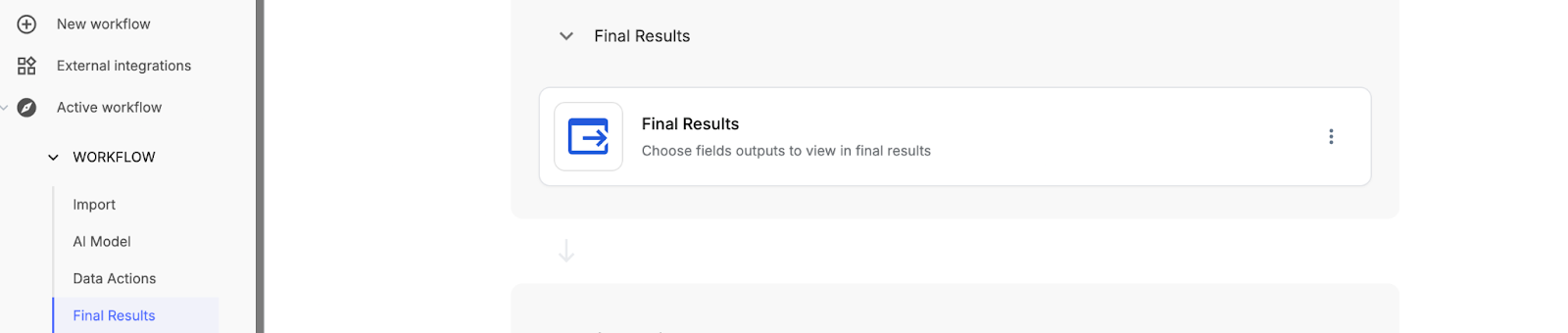

Click on on Again->Workflow->Closing Outcomes to pick the fields to export to Quickbooks.

-

Choose Date, Description, Debit, and Credit score fields from the Closing Outcomes.

-

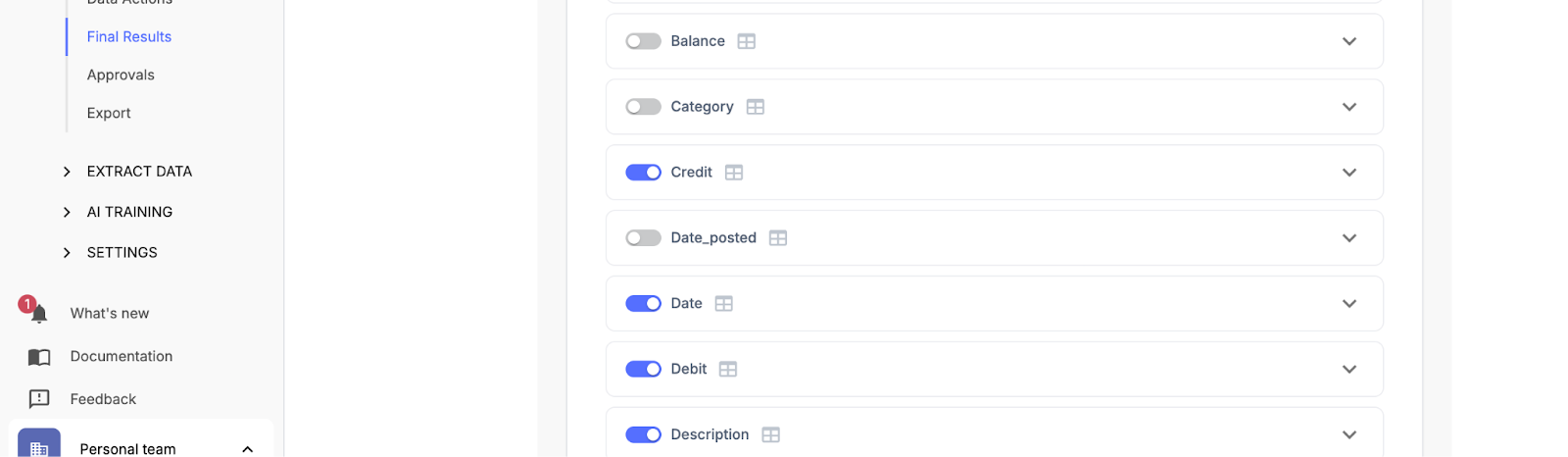

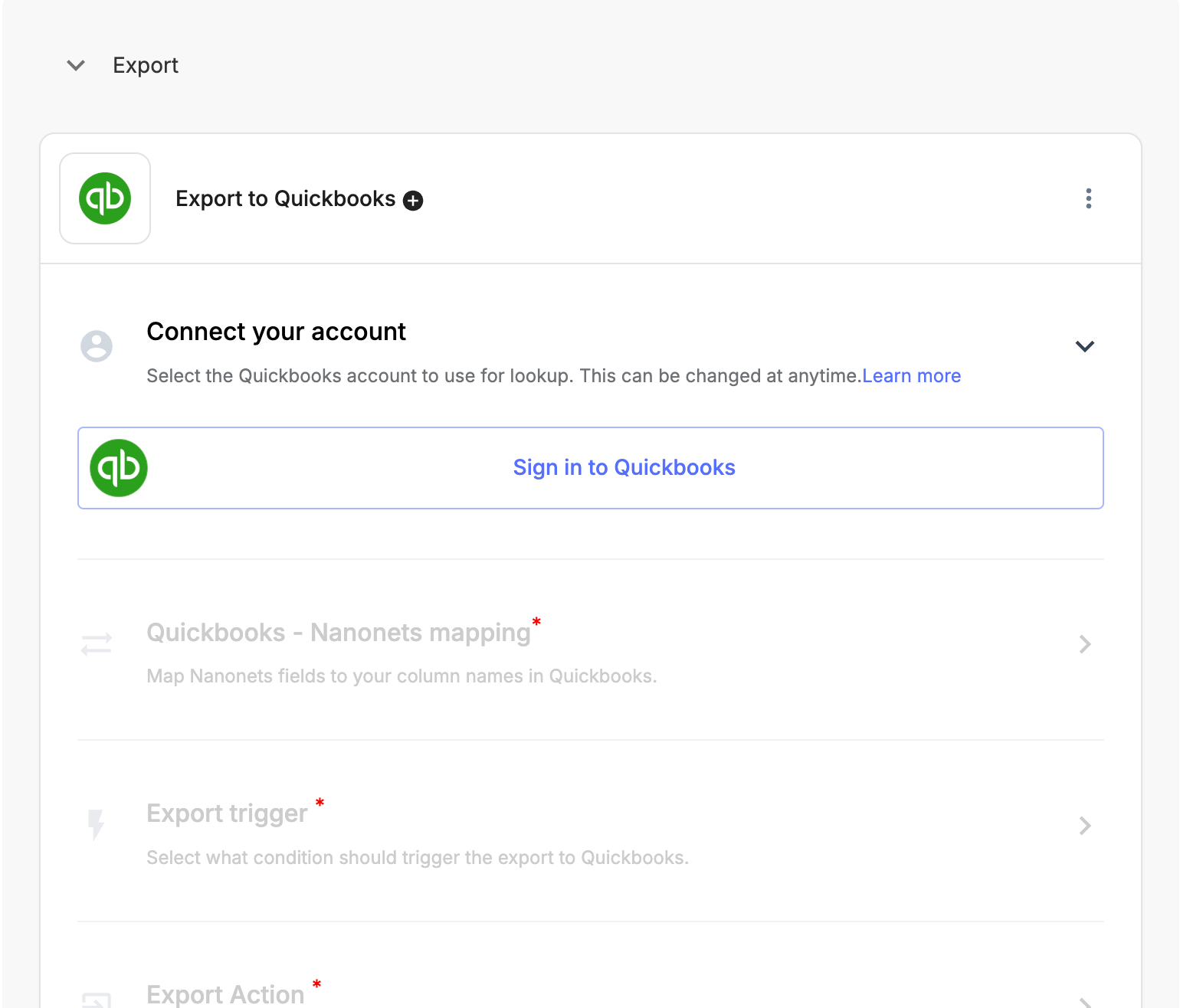

Go to the Export part and click on on Browse all export choices. Choose Quickbooks from the window.

-

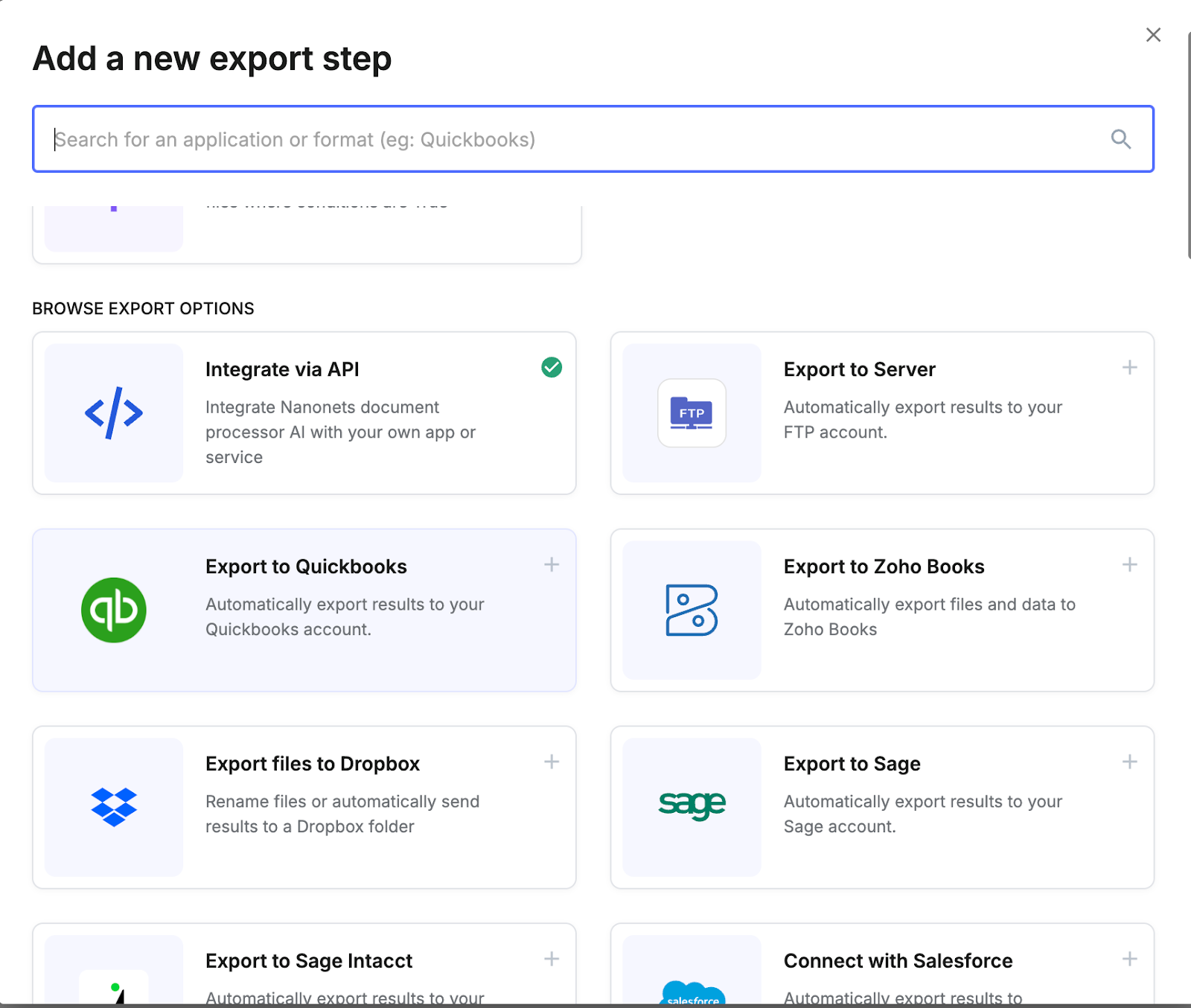

Identify your integration and click on on Configure in Workflow.

-

Register to your Quickbooks account and comply with the directions to setup the Quickbooks integration.

-

That’s it! Now you can routinely export financial institution statements to Quickbooks with none trouble.