Managing numerous claims and infinite paperwork with repeated guide duties is a continuing battle for insurance coverage brokers and underwriters. Whereas the claims backlog grows, buyer complaints pile up.

To maintain up with the rising demand, the insurance coverage trade wants to have the ability to process claims 4X sooner with elevated accuracy. Many insurance coverage corporations are nonetheless caught with inefficient, guide processes the place every agent has to evaluation tons of of paperwork with complicated, unstructured knowledge.

A serious overhaul and transformation is critical.

On this article, we’ll discover human-centric AI options to the most important claims course of challenges and discover the accessible declare automation instruments.

What’s claims course of automation?

50% of insurance coverage working prices come from time-consuming claims processing.

This occurs as a result of each agent has to handle, evaluation, and confirm numerous paperwork to course of a single declare.

Whereas human oversight is essential and irreplaceable, AI-driven options can dramatically enhance claims processing and streamline claims administration course of. By automating routine duties like doc dealing with, data extraction, and validation, brokers can deal with extra strategic duties and construct stronger buyer relationships.

Claims course of automation leverages superior applied sciences like AI, machine studying (ML), and clever doc processing (IDP) to automate repetitive duties similar to declare submission, investigation, and decision-making.

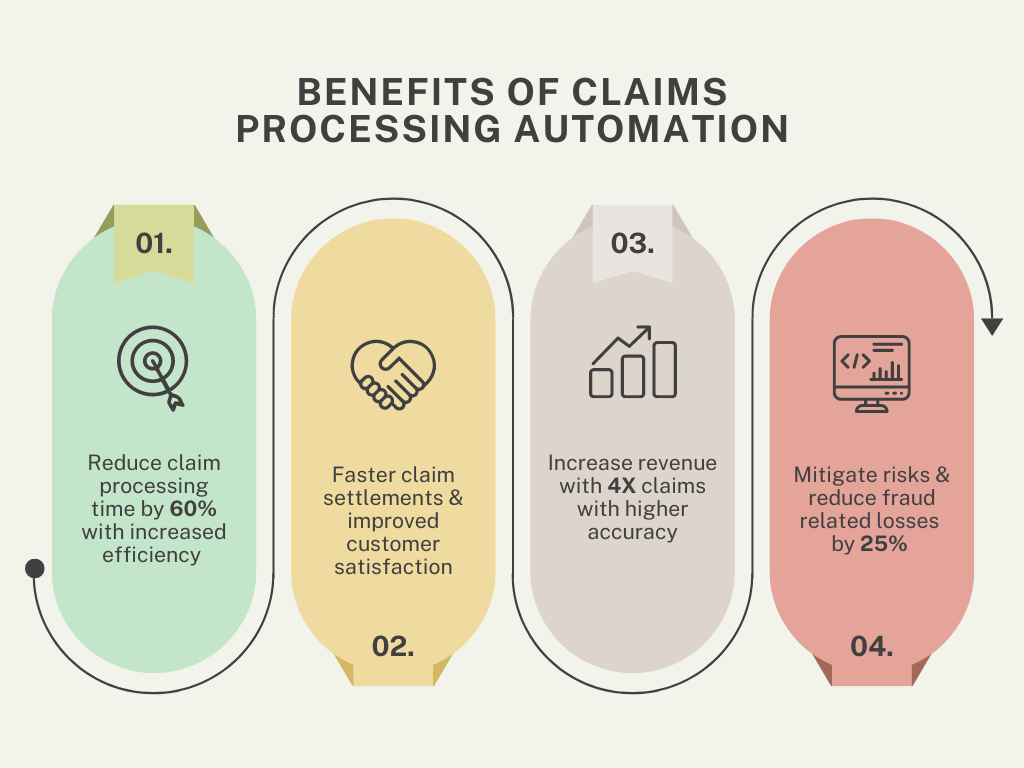

As claims are processed shortly and extra precisely, the advantages are substantial:

- It permits insurers to get rid of repetitive duties like data entry and doc verification, resulting in as much as 80% fewer processing errors, the next quantity of claims processed, shorter declare cycles, and considerably sooner declare settlements.

- Insurers adopting automation additionally report dramatic value reductions, enhanced fraud detection, larger compliance, and a lift in buyer satisfaction.

These declare automation instruments analyze knowledge, study from previous claims, and streamline each course of step, permitting insurers to deal with extra complicated points whereas sustaining full management over claims processing.

Applied sciences in insurance coverage claims processing automation

Let’s discover the important thing applied sciences that drive automated claims processing:

Machine Studying (ML)

By analyzing historic claims knowledge, ML algorithms can determine patterns and developments, predict outcomes, assess danger ranges, and flag fraudulent claims. This reduces guide interventions and expedites claims settlements.

E.g., ML fashions might help corporations precisely estimate restore prices in auto insurance coverage claims by evaluating them towards huge datasets of comparable claims.

Synthetic Intelligence (AI)

AI is especially good at dealing with complicated duties like fraud detection, danger evaluation, and claims adjudication.

Superior AI methods can cross-check declare particulars towards coverage knowledge, third-party databases, and historic declare data to detect anomalies and assess declare validity. This considerably reduces the chance of fraudulent payouts and improves total declare accuracy.

Pure Language Processing (NLP) and Clever Doc Processing (IDP)

NLP extracts data from unstructured knowledge like handwritten notes and emails, whereas IDP makes use of NLP and ML to automate doc processing, lowering evaluation time and enhancing prospects’ experiences.

Robotic Course of Automation (RPA)

RPA automates repetitive, rule-based duties similar to data entry, declare verification, and standing updates. This frees up time for insurers to deal with complicated actions, rising operational effectivity and lowering human error.

Optical Character Recognition (OCR)

Correct OCR digitizes bodily paperwork by changing them into machine-readable textual content. Insurers can swiftly course of types, invoices, and different declare paperwork to extract critical information like names, dates, and declare numbers.

Advanced OCR, mixed with AI, handles doc codecs and high quality variations, making certain knowledge accuracy for additional processing.

Such intelligent automation might help insurance coverage corporations course of hundreds of coverage paperwork sooner and extra precisely.

Claims Processing Automation ROI Calculator

Notes and assumptions (click on to broaden)

- This calculator gives a simplified estimate of the potential ROI from implementing Nanonets Claims Processing Automation.

- The hourly price ought to signify the common hourly wage of staff concerned in guide claims processing.

- The calculation assumes that the time saved by automating claims processing will probably be totally reallocated to different productive duties.

- The calculator makes use of Nanonets’ Professional Plan pricing as a foundation for comparability. Nanonets additionally provides a pay-as-you-go mannequin appropriate for smaller companies or decrease doc volumes, with the primary 500 pages free and a cost of $0.3 per web page thereafter.

- The calculation assumes a constant month-to-month claims quantity and common pages per declare all year long.

- The precise time saved by automating claims processing might differ relying on components similar to declare complexity and system effectivity.

- Implementing claims processing automation might require some upfront funding when it comes to time and assets for setup, integration, and coaching.

- The calculator gives a high-level estimate and shouldn’t be relied upon as a exact monetary projection.

Advantages of claims automation

Automating claims processing provides quite a few benefits that improve the effectivity and effectiveness of insurance coverage operations. Right here’s how:

- Elevated effectivity: Automation reduces guide duties, slicing processing occasions by 60%. Insurers utilizing RPA and AI can deal with 10x extra claims, lowering operational prices and boosting productiveness.

- Sooner declare settlements: AI instruments cut back declare verification and fraud detection from weeks to days. Automated methods lower settlement occasions by 70%, resulting in faster payouts and higher buyer retention.

- Improved customer support: Automation drives 15-20% larger buyer satisfaction by means of sooner processing, real-time updates, proactive communication, and extra correct payouts.

- Elevated income and price financial savings: Superior declare automation boosts income by as much as 20% by means of elevated effectivity and buyer retention whereas minimizing guide work and lowering operational prices by 30%.

- Danger mitigation and fraud prevention: AI-powered fraud detection has lowered the $40 billion annual cost of fraud in the U.S., reducing fraud-related losses by 25% with prompt flagging of suspicious patterns.

The best way to resolve challenges in claims processing with automation

Insurance coverage claims processing includes a number of steps that may take weeks with out automation. Right here’s how automation solves widespread challenges:

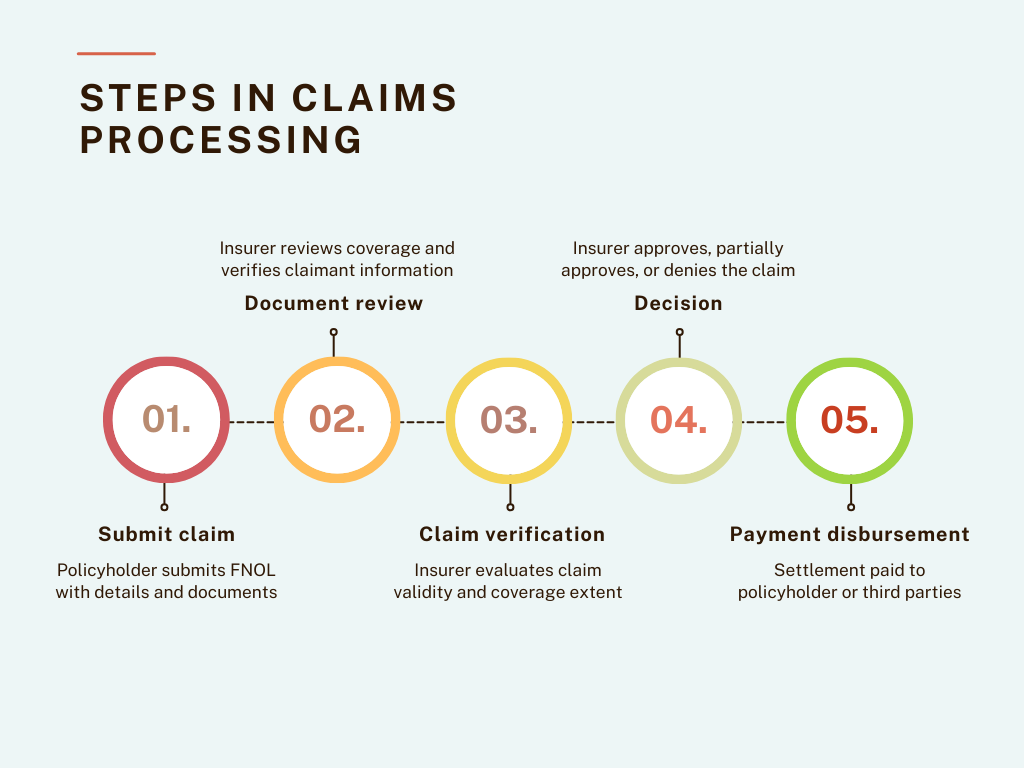

Declare submission

The method begins with the policyholder submitting a First Discover of Loss (FNOL) by means of the insurance coverage platform or the dealer.

The policyholder gives primary details about the declare, such because the date and site of the incident and any supporting documentation or photographs as proof.

Challenges and automatic options within the claims submission course of:

💡

Challenges: Incomplete documentation, multi-channel submissions, duplicate claims, and complicated processes.

Answer: Create a complete self-service portal and implement clever workflows with the next options:

- Automated doc checklists: Information claimants and flag lacking recordsdata in actual time.

- AI chatbot: Information customers by means of the submission course of based mostly on incident particulars

- Pre-filled types: Robotically populate knowledge from current buyer data

- Omnichannel consumption system: Pull claims from all sources (electronic mail, WhatsApp, cloud storage) right into a single digital platform

- AI-driven document parser: Convert claims from a number of codecs into standardized digital codecs

- Automated deduplication: Use ML to flag duplicate recordsdata and route them for obligatory human evaluation.

- Clever approval workflows: Use conditional logic to handle multi-step processes based mostly on declare complexity. Robotically route high-risk or precedence claims to related key individuals.

- Guided form-filling and reminders: Present estimated completion occasions, explanations for complicated phrases, and reminders for pending gadgets.

Assessment and verification

After the declare is submitted, it goes by means of an in depth evaluation and verification course of to substantiate the accuracy of the data supplied.

This step focuses on gathering and verifying supporting evidence, together with assessing reported damages and validating claimant identification.

Insurers use numerous strategies, similar to consulting third-party databases and analyzing the supplied documentation, to make sure that all obligatory particulars are appropriate and correct earlier than continuing.

Challenges and automatic options within the declare evaluation and verification course of:

💡

Challenges: Time-consuming guide evaluation, unstructured knowledge, a number of knowledge sources, and lack of coordination.

Answer: Implement an built-in AI-powered evaluation system with the next options:

- Superior OCR and NLP: Extract and analyze data from submitted paperwork with 97%-99% accuracy.

- ML algorithms: Confirm doc authenticity and detect tampering or fraud.

- AI doc processing: Use automated knowledge extraction instruments to precisely deal with numerous codecs (PDFs, scanned images, handwritten text).

- API integration: Join with exterior databases (e.g., DMV data, medical databases, credit score bureaus) for knowledge verification.

- Multilingual functionality: Extract significant knowledge from free-text descriptions in numerous languages.

- Collaboration instruments: Facilitate communication between departments to streamline approvals.

Declare validation and determination

As soon as the declare is verified, the subsequent step is to find out its eligibility. This includes evaluating the declare towards coverage phrases, assessing the extent of protection, and deciding whether or not to approve, partially approve, or deny the declare.

At this stage, all verified proof is analyzed, and if the declare meets the coverage standards, the insurer calculates the suitable payout.

Challenges and automatic options within the claims validation and determination course of:

💡

Challenges: Complicated coverage interpretation, inconsistent choices, excessive false positives in fraud detection, and figuring out payout quantities.

Answer: Implement an clever decision-making system that features:

- Rule-based workflow: Use constant standards throughout all claims.

- ML fashions: Leverage historic knowledge for standardized decision-making.

- Adaptive fraud detection: Refine fraud detection standards utilizing suggestions from human reviewers.

- Behavioral analytics: Differentiate respectable claims from fraudulent ones by creating detailed policyholder profiles.

- AI-powered payout calculation: Use rule-based calculators to consider coverage limits, incident sort, and market circumstances to make sure correct payouts and cut back disputes and dissatisfaction.

Declare payout

The ultimate step of cost disbursement includes transferring the accepted settlement quantity to the policyholder or third events, similar to restore amenities or healthcare suppliers.

Delays or errors in payouts breed distrust and dissatisfaction, making it important to make sure this step is each correct and accomplished in time.

Challenges and automatic options within the claims disbursement course of:

💡

Challenges: Fee mismatches, lack of transparency, disputes, and compliance points.

Answer: Implement a complete automated payout system with:

- Validation checks: Cross-reference payout quantities towards coverage phrases to keep away from mismatches.

- Actual-time cost monitoring: Present updates by means of digital portals or cell apps.

- Prompt acknowledgment: Ship monitoring IDs to policyholders upon declare approval.

- Versatile cost administration: Allow changes or reversals when obligatory.

- Built-in monetary administration: Automate tax calculations, generate required tax paperwork (e.g., 1099 forms, Form 1040 (Schedule A), Kind 720), and match disbursements with inside data utilizing API integration.

- Automated auditing and reporting: Streamline monetary reporting processes and guarantee compliance.

Let’s take a look at a few of the finest instruments which can be leveraging superior AI to automate completely different steps of claims processing within the insurance coverage trade:

Greatest for automating claims submission

- Snapsheet provides a digital claims platform that enables policyholders to submit claims on-line or by means of a cell app.

- ClaimVantage by Majesco gives a sophisticated cloud-based claims administration system tailor-made for all times, well being, and incapacity insurance coverage. It provides automated workflows, on-line declare submission, and monitoring capabilities.

- Lemonade automates the claims course of, from submission to decision-making. Its AI bot, “Jim,” processes claims immediately, assessing eligibility and disbursing funds inside minutes for easy claims.

Greatest for doc verification and validation

- Nanonets OCR expertise automates the extraction of key data from declare types, similar to coverage numbers, claimant names, and injury descriptions. By leveraging machine studying algorithms, Nanonets helps insurers shortly validate claims, lowering guide work and enhancing accuracy.

Trusted by 34% of Fortune 500 corporations, Nanonets is especially widespread for automating document-heavy processes like claims validation, medical records, forms data extraction, and even handwritten scanned paperwork.

- Tractable makes use of pc imaginative and prescient and AI to evaluate automobile injury and robotically decide the suitable restore prices. Tractable’s AI could make fast, data-driven choices, considerably lowering the time required to settle auto insurance coverage claims.

- Verisk Analytics: Gives an in depth suite of instruments for claims validation, together with predictive analytics, property and casualty claims analytics, and medical invoice evaluation. This device is trusted to validate complicated claims similar to employees’ compensation and property injury.

Greatest for claims verification and fraud detection

- Shift Technology is widespread for its AI-driven fraud detection capabilities. It analyzes claims knowledge to determine potential fraud, errors, and anomalies. Its algorithms are skilled on huge datasets, making certain excessive accuracy in flagging suspicious claims, thereby lowering the chance of fraudulent payouts.

- FRISS is a complete insurance coverage fraud detection platform that makes use of AI and predictive analytics to watch and confirm claims. It evaluates danger scores in real-time through the declare lifecycle, serving to insurers detect and stop fraud at an early stage.

Greatest for claims calculation and payouts

- Octo Telematics makes use of knowledge to research driving conduct and alter premiums based mostly on danger, resulting in extra correct pricing and higher danger administration.

- Checkbook.io provides a digital test platform that enables insurers to challenge funds electronically and securely.

- One Inc gives a digital funds platform designed particularly for the insurance coverage trade. One Inc. provides safe, real-time cost options for claims disbursement by way of ACH, bank cards, and digital wallets. Its integration with current claims methods ensures seamless and environment friendly cost processing.

The best way to arrange a claims automation course of utilizing Nanonets

- Join on Nanonets at app.nanonets.com.

- Select the acceptable Pre-Constructed Extractor mannequin for declare paperwork similar to invoices receipts, or use the Zero-training AI mannequin.

- Add all of your paperwork and await the mannequin to extract knowledge from them.

- Customise completely different fields per doc to extract solely related data precisely.

- Assessment all of the extracted data from every doc.

Doc evaluation and verification

- Share/Export all of the extract paperwork for additional approvals by organising evaluation workflows.

- Arrange an approval workflow and share the extracted knowledge file with stakeholders.

- Relying on the precedence and danger of claims, add guidelines to focus on or flag them. Add a number of critiques—obligatory or non-compulsory for various kinds of claims.

- Arrange automated notifications for reminders to get fast approvals by integrating Slack, E mail, or another inside channel.

Declare validation

- Arrange knowledge validation by enriching the extracted knowledge with personalized actions, for instance:

- For cross-border claims, use actions like foreign money converter or eradicating foreign money symbols to maintain solely numbers, decimals, and commas in quantities, changing date codecs

- For repeat claimants, search for knowledge from databases and exterior sources similar to PostgreSQL, MySQL, accounting software program, or Google Sheets.

Integrations for funds and accounting

- Combine together with your accounting or ERP instruments for environment friendly workflow automation throughout all platforms with API integrations.

- You may arrange built-in workflows with any third-party or in-house system to make sure seamless knowledge circulate.

- For instance: If you have already got an insurance coverage claims administration platform, combine the device to automate solely particular steps of the method (like correct OCR extraction or organising approval workflows).