- Nvidia has loads using on Blackwell, its new flagship AI chip.

- Traders had a tepid response to earnings regardless of reporting $35.1 billion in third-quarter income.

- To ship with Blackwell, Nvidia should juggle efficiency expectations and complicated provide chains.

Nvidia appears set to finish the 12 months as confidently because it began. How subsequent 12 months performs out will considerably depend upon the efficiency of Blackwell, its next-generation AI chip.

The Santa Clara-based chip large reminded everybody why it has grown greater than 200% this 12 months to turn out to be the world’s most beneficial firm. On Wednesday, it reported one other blowout earnings. Income hit $35.1 billion in its third quarter, up 94% from a 12 months in the past.

However regardless of the robust earnings, which Wedbush analyst Dan Ives stated “needs to be framed and hung within the Louvre,” traders remained cautious as they centered their consideration on the highwire act Nvidia should pull off with Blackwell.

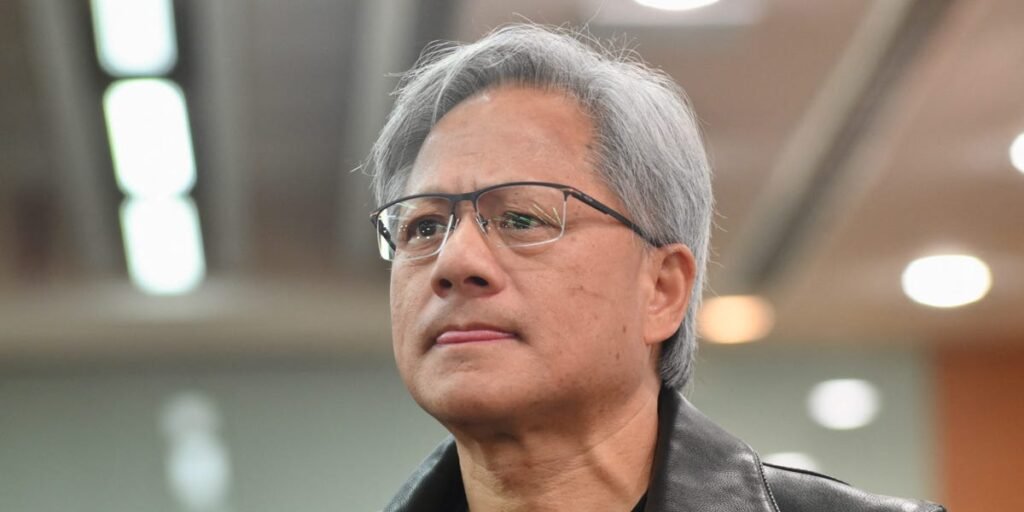

The brand new chip, often called a GPU, was first unveiled by CEO Jensen Huang on the firm’s GTC convention in March. It was revealed as a successor to the Hopper GPU that corporations throughout Silicon Valley and past have used to construct highly effective AI fashions.

Whereas Nvidia confirmed on Wednesday that Blackwell is now “in full manufacturing,” with 13,000 samples shipped to prospects final quarter, indicators emerged to counsel that Nvidia faces a tough path forward because it prepares to scale up its new-era GPUs.

Nvidia should navigate advanced provide chains

First, Blackwell is what Nvidia CFO Colette Kress referred to as a “full-stack” system.

That makes it a beast of equipment that must be match for an extremely big selection of particular wants from a wide range of prospects. As she advised traders on the earnings name on Wednesday, Blackwell is constructed with “customizable configurations” to deal with “a various and rising AI market.” That features every part from “x86 to Arm, coaching to inferencing GPUs, InfiniBand to Ethernet switches,” Kress stated.

Nvidia can even want unimaginable precision in its execution to fulfill its prospects. As Kress stated on the earnings name, the road for Blackwell is “staggering,” with the corporate “racing to scale provide to fulfill the unimaginable demand prospects are putting on us.”

To attain this, it will must give attention to two areas. First, assembly demand for Blackwell will imply effectively orchestrating an extremely advanced and widespread provide chain. In response to a query from Goldman Sachs analyst Toshiya Hari, Huang reeled off a near-endless checklist of suppliers contributing to Blackwell manufacturing.

Nvidia

There have been Far East semiconductor companies TSMC, SK Hynix, and SPIL; Taiwanese electronics large Foxconn; Amphenol, a producer of fiber optic connectors in Connecticut; cloud and information middle specialists like Wiwynn and Vertiv, and several other others.

“I am positive I’ve missed companions which are concerned within the ramping up of Blackwell, which I actually recognize,” Huang stated. He’ll want every one in every of them to be in sync to assist meet subsequent quarter’s steering of $37.5 billion in income. There had been some current solutions that cooling issues were plaguing Blackwell, however Huang appeared to counsel they’d been addressed.

Kress acknowledged that the prices of the Blackwell ramp-up will result in gross margins dropping by just a few share factors however expects them to get better to their present stage of roughly 75% as soon as “totally ramped.”

All eyes are on Blackwell’s efficiency

The second space Nvidia might want to execute with absolute precision is efficiency. AI corporations racing to construct smarter fashions to maintain their very own backers on board will depend upon Huang’s promise that Blackwell is way superior in its capabilities to Hopper.

Reviews up to now counsel Blackwell is on monitor to ship next-generation capabilities. Kress reassured traders on this, citing outcomes from Blackwell’s debut final week on the MLPerf Training benchmark, an trade check that measures “how briskly methods can prepare fashions to a goal high quality metric.” The Nvidia CFO stated Blackwell delivered a “2.2 instances leap in efficiency over Hopper” on the check.

Collectively, these efficiency leaps and supply-side pressures matter to Nvidia for a longer-term cause, too. Huang dedicated the corporate to a “one-year rhythm” of new chip releases earlier this 12 months, a transfer that successfully requires the tech large to showcase a vastly extra highly effective number of GPUs every year whereas convincing prospects that it might dole them out.

Whereas efficiency features appear to be displaying actual enhancements, experiences this 12 months have advised that ache factors have emerged in manufacturing which have added delays to the rollout of Blackwell.

Nvidia stays forward of rivals like AMD

For now, traders seem like taking a wait-and-see strategy to Blackwell, with Nvidia’s share value down lower than a share level in pre-market buying and selling. Hamish Low, analysis analyst at Enders Evaluation, advised BI that “the truth is that Nvidia will dominate the AI accelerator marketplace for the foreseeable future,” notably as “the wave of AI capex” anticipated from tech companies in 2025 will guarantee it stays “the large winner” within the absence of robust competitors.

“AMD is a methods behind and not one of the hyperscaler chips are going to be matching that sort of quantity, which provides Nvidia some respiration room by way of market share,” Low stated.

As Low notes, nonetheless, there’s one other actuality Nvidia should reckon with. “The problem is the sheer weight of investor expectations as a result of scale and premium that Nvidia has reached, the place something lower than frequently flying previous each expectation is a disappointment,” he stated.

If Blackwell misses these expectations in any manner, Nvidia might must brace for a fall.