Invoicing and managing accounts payable digitally are a truth of life for enterprise homeowners as we speak, whether or not a small, native mom-and-pop or an eCommerce juggernaut promoting 1000’s of {dollars} value of stock every day.

Although digitization has come a good distance, it hasn’t but alleviated all of the pains related to balancing the books, maintaining distributors completely happy, and guaranteeing optimum money stream – simply ask anybody skilled with operating their accounts by Excel workbooks.

QuickBooks affords a spread of fundamental accounts receivable and payable options to simplify many tough processes. We’ll have a look at tips on how to use QuickBooks to ship invoices and streamline funds, just a few flaws inside the platform, and the way third-party integrations can step in to save lots of the day.

QuickBooks Invoicing – Accounts Receivable

QuickBooks is well-known for its wide-ranging options and instruments – and its accounts receivable choices are not any exception. With QuickBooks’ fundamental variations, customers will get pleasure from a spread of easy-to-use invoicing tools that embrace:

- Bespoke and customizable invoices to maintain your model’s messaging on-point all through your buyer or consumer’s buying cycle.

- The power to maintain tabs on money stream by monitoring invoicing in real-time, together with after they’re despatched, seen, and (most significantly) paid.

- Built-in cost choices that embrace ACH switch, bank cards, and even digital wallets – with third-party integrations unlocking much more cost flexibility.

All of those supply one main profit: saving time by streamlining your workflows and, in some circumstances, automating handbook work that additionally reduces or eliminates human error that usually happens when coming into knowledge by hand.

Methods to Ship an Bill with QuickBooks

As you’ve doubtless come to anticipate from QuickBooks, sending and monitoring invoicing by the platform is a breeze.

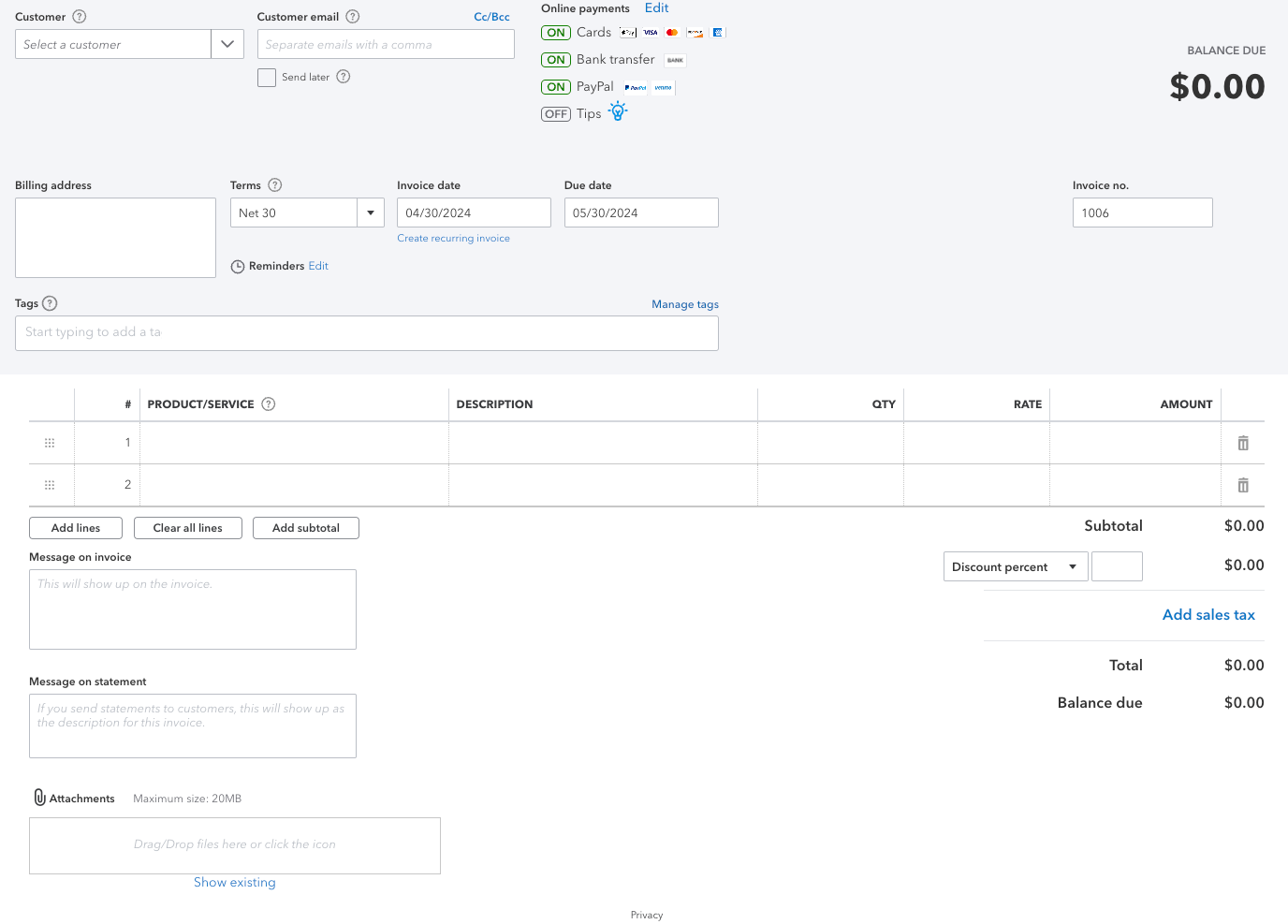

- To get began, navigate to your Invoicing or Gross sales part of the dashboard, then click on Create Bill.

- From there, you’ll have an choice to both choose an present buyer or create a brand new consumer profile.

- You’ll fill out all related info and have a possibility to decide on on-line cost strategies (on this case, playing cards, financial institution switch, and PayPal can be found) and arrange an auto-invoice reminder three days earlier than the due date, on the due date, and a late cost reminder three days after.

- As soon as prepared, click on Save or Save and ship for those who’re ready for the consumer to obtain your bill. If you happen to save the bill, you’ll find it on the primary Gross sales dashboard and ship it later.

Earlier than sending, you’ll have a ultimate alternative to evaluate the bill and even see the structure from the shopper’s perspective.

Processing Invoices with QuickBooks – Accounts Payable

Like sending invoices and managing accounts receivable, maintaining your accounts payable straight by QuickBooks is straightforward. There are, nevertheless, some essential shortfalls within the course of that we’ll tackle – in addition to some really useful methods to easy out these tough edges to maintain your small business operating easily and money stream optimized.

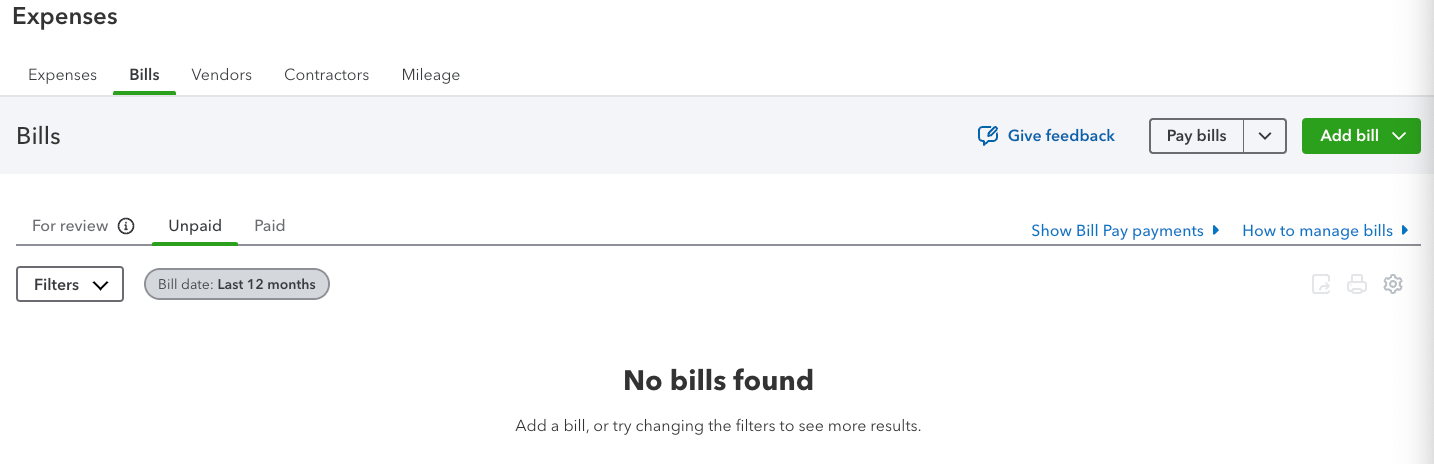

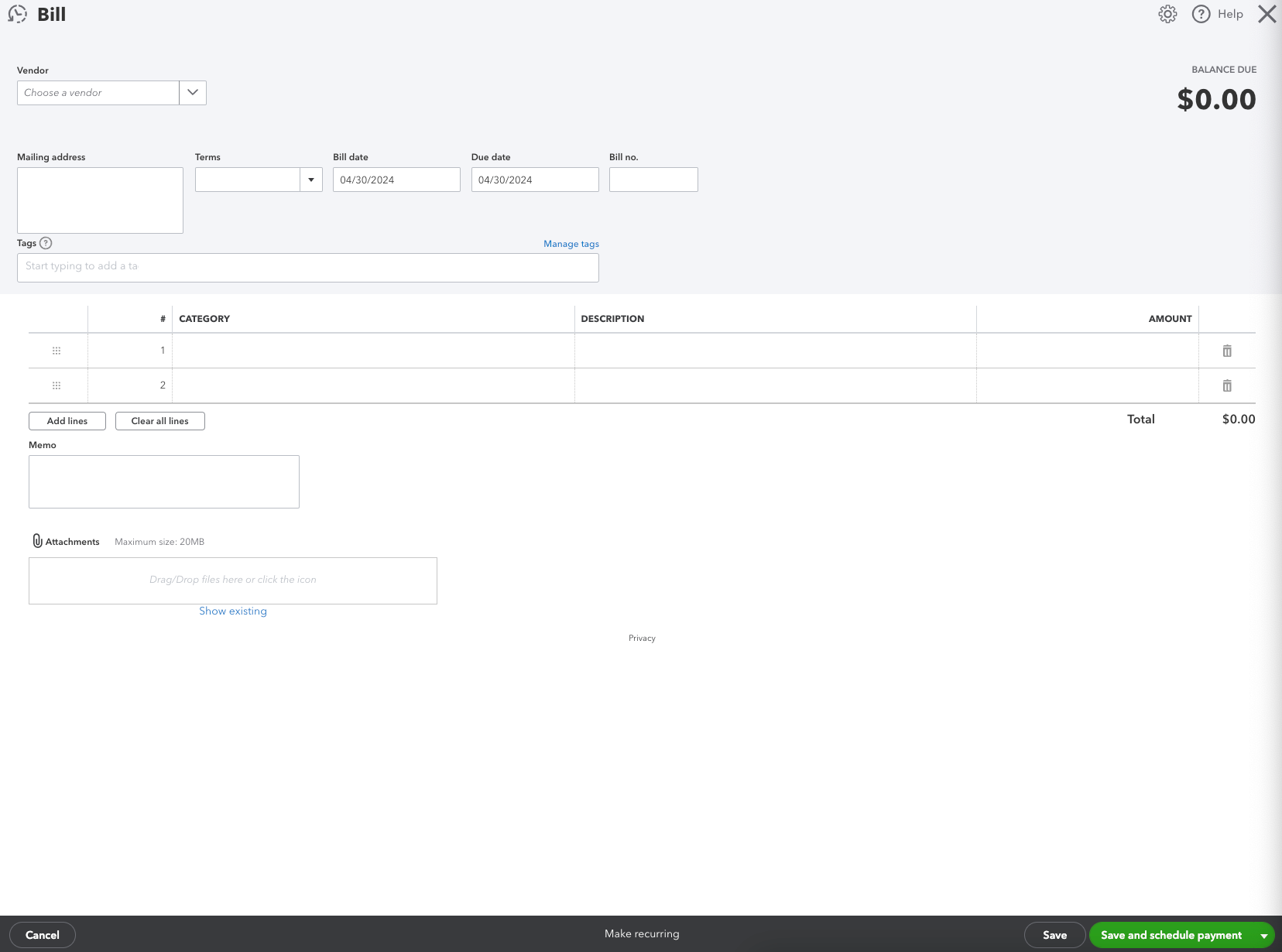

To course of invoices in QuickBooks, you’ll first want the bill itself, whether or not it’s bodily, emailed, or despatched by one other platform. You’ll migrate the bill into QuickBooks by navigating to the Bills dashboard and deciding on Payments.

- Navigate to the Add invoice dropdown menu and choose both Add from pc (if emailed or you have got a digital copy) (or)

- Create invoice you probably have a paper copy or in any other case want handbook knowledge entry.

- As soon as prepared, you’ll migrate all related info into the seller’s administrative fields, then both Save the bill or Save and schedule cost for those who’re able to pay.

You’ll even have the choice to make the invoice recurring if the seller’s items or companies come at a preplanned and agreed-upon schedule with out substantial adjustments from interval to interval.

Gaps in QuickBooks’ Accounts Payable Course of

Even with QuickBooks ‘ professional help, managing payments and bills could be tough. Widespread gaps prospects establish of their QuickBooks accounts payable processing embrace:

- Delayed or inaccurate bill entries on account of handbook processes can pressure vendor relationships.

- Likewise, errors in handbook knowledge entry may cause devasting monetary ramifications in the event that they go unnoticed.

- A scarcity of oversight and approvals inside QuickBooks’ native platform has prompted fraud or, at greatest, misaligned spending inside organizations and not using a tight grip on spending.

Different frequent points recognized embrace the dearth of early cost low cost choices and, in some circumstances, inefficient cost processes that come into play, primarily when coping with worldwide and cross-border payments.

In fact, a spread of automation instruments and third-party integrations step in to save lots of the day – certainly one of which, Nanonets, affords a full spectrum suite of accounts payable automation tools for QuickBooks that elevate the platform to the subsequent stage.

Nanonets for Accounts Payable (AP) Automation

Nanonets affords a spread of AI-powered doc processing and accounts payable integrations that assist flip QuickBooks into an accounting powerhouse. The back-end processes are advanced, although the person expertise is a breeze, however, in a nutshell, Nanonets helps automate accounts payable in QuickBooks by:

- Migrating and “studying” invoices from a spread of sources, together with scanned copies by optical character recognition, then extracting the related knowledge into your QuickBooks accounts payable.

- Automating funds primarily based in your preferences, pushed by the extracted knowledge, with accuracy as a key characteristic to reduce vendor battle and forestall cost points.

- Vendor management tools, together with onboarding options and customizable approval workflows.

The advantages of integrating Nanonets into QuickBooks are clear – customers can save as a lot as 90% of the time in any other case spent manually managing QuickBooks’ accounts payable by AI-enabled automation. Likewise, placing AI to work means fewer errors that may be crippling to your small business’s money stream and long-term development objectives.

How QuickBooks and Nanonets Work Collectively

You may shortly combine Nanonets with QuickBooks with out pricey and time-consuming onboarding necessities – it’s so simple as just a few clicks. As soon as built-in, your Nanonets-enabled workflow will typically look one thing like this:

- You’ll obtain an bill and migrate to Nanonets by way of API, e-mail, or drag-and-drop out of your native machine.

- Nanonets will robotically and precisely seize all info after which ship it to the primary approver (for those who set your workflow guidelines and permissions to incorporate approvals alongside the way in which).

- As soon as accepted, which customers can do remotely, Nanonets will match the bill to an present buyer or create a brand new vendor primarily based on the extracted knowledge. Nanonets will then reconcile the related data in QuickBooks to make sure your bookkeeping is up to date and correct in real-time.

- Nanonets will then create payments which can be prepared for cost, which you’ll be able to automate or manually launch.

As you’ll be able to inform, Nanonets’ AI integrations flip dozens of steps into only a handful of automated processes that, in lots of circumstances, can safely run within the background. On the identical time, you focus your time, consideration, and efforts on the issues that matter – rising your small business.

Conclusion

QuickBooks affords a largely all-in-one accounting and bookkeeping platform that’s perennially well-liked for a motive. Although there’s a little bit of a studying curve, sending invoices and paying bills by QuickBooks is a simple course of as soon as you’ll be able to navigate the platform’s many dashboards.

In fact, that navigation and familiarity requirement comes at a worth – your time. Worse but, you’ll be able to anticipate time spent on accounts payable to compound when manually coming into knowledge fields and hand-walking a invoice from bill reception to cost. For these occupied with streamlining their accounts payable expertise and turbocharging QuickBooks, Nanonets’ suite of automation instruments saves time and power whereas providing respiratory room and suppleness to customers managing their newfound freedom.

If you happen to’re able to kickstart your QuickBooks expertise, try Nanonets today without cost to see how a lot time you’ll save.