Welcome to our newest weblog submit, the place we embark on a deep dive into the intricacies of the Common Ledger (GL) — the bedrock of any enterprise’s monetary system.

We’ll begin with the fundamentals: What precisely is a Common Ledger, and why is it paramount to your enterprise’s monetary well being? We’ll unravel the Chart of Accounts, the spine of the GL, detailing how transactions are organized and recorded.

We’ll additionally discover methods to effectively handle and make the most of your Common Ledger, together with the implementation of recent software program options to automate and streamline your accounting processes. In an period the place effectivity and accuracy are paramount, harnessing expertise to handle your Common Ledger could be a game-changer.

Whether or not you are a small enterprise proprietor, a finance skilled, a CFO, or just curious in regards to the monetary operations of a enterprise, this weblog collection guarantees to equip you with a radical understanding of the Common Ledger, its significance and it is efficient implementation inside a enterprise.

What’s a Common Ledger?

At its core, a basic ledger is an entire report of all monetary transactions that happen inside an organization over its lifetime. This meticulous doc serves as the inspiration for a corporation’s monetary statements, categorizing and recording every transaction. Via this rigorous group, it supplies an important snapshot, providing a complete view of the corporate’s monetary well being and facilitating detailed monetary evaluation and reporting.

Let’s perceive this intimately.

Chart of Accounts

The overall ledger is organized right into a Chart of Accounts that mirror an organization’s monetary transactions throughout varied classes. These main accounts are important in portray a complete image of an organization’s monetary well being and embody belongings, liabilities, fairness, income, and bills.

- Belongings are sources owned by the corporate which have financial worth and could be transformed into money. Examples embody money, stock, and property.

- Liabilities symbolize the corporate’s obligations or money owed that it should pay to different entities. These could be loans, accounts payable, or mortgages.

- Fairness refers back to the proprietor’s claims after subtracting liabilities from belongings, basically representing the online belongings owned by the shareholders.

- Income accounts monitor the revenue generated from the corporate’s operations, like gross sales and providers.

- Bills account for the prices incurred in producing income, together with prices like hire, utilities, and salaries.

Sub-Categorization

Inside every primary class, a enterprise can create personalised subcategories that mirror the nuances of it is operations. Beneath is an instance of a framework with potential subcategories. Click on on every class and subcategory to discover additional.

Money and Money Equivalents

Accounts Receivable

Stock

Pay as you go Bills

Property, Plant, and Tools (PP&E)

Intangible Belongings

Shares, bonds, or actual property

Accounts Payable

Accrued Bills

Brief-term Loans

Lengthy-term Loans

Deferred Tax Liabilities

Bonds Payable

Capital

Retained Earnings

Widespread Inventory

Most well-liked Inventory

Gross sales Income

Service Income

Curiosity Earnings

Rental Earnings

Dividend Earnings

Price of Items Offered (COGS)

Payroll

Hire

Utilities

Advertising and Promoting

Insurance coverage

Depreciation and Amortization

Curiosity Expense

Losses from Asset Gross sales

By embracing element inside every primary GL account, you create a sturdy system that precisely displays your enterprise operations. Nonetheless, keep in mind the precept of avoiding overcomplication: tailor your subcategories to match the particular wants and scale of your enterprise, making certain that your GL account construction stays each helpful and manageable.

GL Coding

Common Ledger Codes, or GL Codes, are distinctive alphanumeric strings that classify and report monetary transactions inside an organization’s basic ledger into corresponding GL account. Every GL account is related to corresponding GL code. These codes function the basic constructing blocks of a enterprise’s monetary construction, enabling the categorization of transactions into distinct accounts for revenues, bills, belongings, liabilities, and fairness. As an example, a GL code for workplace provides expense helps be certain that all expenditures associated to workplace provides are grouped collectively, facilitating simpler monitoring and evaluation.

The Division of Justice permits using a five-digit community for every sector (main account class) to make sure there are ample particular person identification numbers to incorporate subcategorization.

- Belongings—10000 collection

- Liabilities—20000 collection

- Internet belongings—30000 collection

- Revenues—40000 collection

- Bills—50000 collection

When designing your GL codes, take into account the next:

- Degree of Element: Decide the granularity of data you want. Whereas element is efficacious, an excessive amount of can overwhelm your system and customers.

- Sub Account Codes: In case your constitution of accounts has subcategorization past the 5 classes, create GL code ranges for the subcategories. (eg. inside “Belongings” account with GL codes in 10000 collection, create subcategories reminiscent of 10000-11000 for “present belongings”, 11000-12000 for “mounted belongings”. Additional categorization may imply that inside 10000-11000 for “present belongings”, we assign 10000-10300 for “Accounts Receivable”, 10300-10600 for “Pay as you go Bills”, 10600-10999 for “Stock”.)

As soon as your classes, subcategories and GL codes are arrange, you may have successfully constructed your chart of accounts. Here is an snippet of what a Chart of Accounts would possibly finally appear to be.

| ID | Title | ID | Title | Kind | Facet |

|---|---|---|---|---|---|

| 1010 | Gross sales – Shopper Electronics | 10 | Gross sales | Earnings | Cr |

| 1020 | Gross sales – Residence Home equipment | 10 | Gross sales | Earnings | Cr |

| 1030 | Gross sales – Workplace Tools | 10 | Gross sales | Earnings | Cr |

| 1040 | Gross sales – Cellular Units | 10 | Gross sales | Earnings | Cr |

| 1050 | Gross sales – IT Options | 10 | Gross sales | Earnings | Cr |

| 1060 | Gross sales – Wearable Tech | 10 | Gross sales | Earnings | Cr |

| 1070 | Gross sales – Software program Options | 11 | Gross sales | Earnings | Cr |

| 1080 | Gross sales – Service Contracts | 10 | Gross sales | Earnings | Cr |

| 1090 | Gross sales – Technical Help | 10 | Gross sales | Earnings | Cr |

| 2000 | Curiosity Obtained | 15 | Curiosity | Earnings | Cr |

| 2010 | Consulting Earnings | 16 | Providers | Earnings | Cr |

| 2020 | Miscellaneous Earnings | 17 | Different Earnings | Earnings | Cr |

| 2030 | Dividend Earnings | 17 | Different Earnings | Earnings | Cr |

| 2040 | Achieve on Funding Sale | 17 | Different Earnings | Earnings | Cr |

| 3000 | COGS – Shopper Electronics | 20 | Price of Gross sales | Price of Items | Dr |

| 3010 | COGS – Residence Home equipment | 20 | Price of Gross sales | Price of Items | Dr |

| 3020 | COGS – Workplace Tools | 20 | Price of Gross sales | Price of Items | Dr |

| 3030 | COGS – Cellular Units | 20 | Price of Gross sales | Price of Items | Dr |

| 3040 | COGS – IT Options | 20 | Price of Gross sales | Price of Items | Dr |

| 3050 | COGS – Wearable Tech | 20 | Price of Gross sales | Price of Items | Dr |

| 3060 | COGS – Software program Options | 21 | Direct Prices | Price of Items | Dr |

| 3070 | COGS – Service Contracts | 20 | Price of Gross sales | Price of Items | Dr |

| 3080 | COGS – Technical Help | 20 | Price of Gross sales | Price of Items | Dr |

| 4000 | Wages – Manufacturing Employees | 22 | Wages | Different Prices | Dr |

| 4010 | Wages – Gross sales Crew | 22 | Wages | Different Prices | Dr |

| 4020 | Wages – Administrative Employees | 22 | Wages | Different Prices | Dr |

| 4030 | Wages – Analysis & Improvement | 22 | Wages | Different Prices | Dr |

| 4040 | Wages – IT Help Employees | 22 | Wages | Different Prices | Dr |

| 4050 | Wages – Government Salaries | 22 | Wages | Different Prices | Dr |

Now that we perceive the chart of accounts, let’s discover methods to use the system to populate the overall ledger and report transactions in it as they occur.

Double-Entry Bookkeeping

Every transaction recorded within the basic ledger is entered as both a debit or a credit score, based mostly on the double-entry bookkeeping system. This method ensures that for each transaction, a corresponding and reverse entry is made to a different account, sustaining the accounting equation’s stability.

💡

Think about a small café that buys a brand new espresso machine for $1,000. Within the Common Ledger, this transaction impacts two accounts: the café will increase its “Tools” account (Asset) by $1,000 (debit) and reduces its “Money” account (Asset) by $1,000 (credit score). This retains the accounting equation balanced, as the rise in gear belongings is offset by a lower in money belongings. It is a sensible instance of how each enterprise transaction is recorded within the Common Ledger to mirror the true monetary state of the enterprise precisely.

Debits and credit have an effect on the accounts in a different way; for example, debits enhance belongings and bills however lower liabilities and fairness, whereas credit have the other impact. This methodology of recording transactions ensures the accuracy and integrity of economic data, offering a transparent and balanced view of the corporate’s monetary standing.

Instance of a Common Ledger

Given beneath is an occasion of an accounting system with a basic ledger for a fictitious account, ABCDEFGH Software program.

- The leftmost part within the occasion above is the period of the transaction.

- To its proper is the journal entry quantity correlated with the transaction, which incorporates an figuring out amount correlated with the transaction.

- The reason of the transaction is within the following column. It asserts the explanation behind the transaction. For this occasion, a given transaction is for a financial fee from a buyer account to ABCDEFGH Software program. For the reason that cash account is acquiring revenue, then the debit part will present a achieve and show an quantity for the quantity. On this case, it’s $10,000.

- For this transaction, the credit score part will keep intact for this account. Nonetheless, a definite ledger entry for the company’s accounts receivable will point out a credit score deduction for a similar quantity, as a result of ABCDEFGH Software program now not has that proportion receivable from its buyer.

To retain the accounting equation’s net-zero discrepancy, one asset account should improve whereas one other reduces by an identical quantity. The current stability for the money account, after the online change from the transaction, will then be mirrored within the stability class.

Recording Transactions

The realm of GL accounting is operated by debits and credit. Debits and credit create a e book’s world go ‘spherical. You could doc debits and credit for every transaction.

Comply with the three golden legal guidelines of accounting whereas recording transactions –

1. Debit the receiver and credit score the giver

The legislation of debiting the receiver and crediting the giver arrives on the present with private experiences. A private account is a basic ledger pertaining to individuals or establishments. In case you get hold of one thing, debit the account. In case you present one thing, credit score the account.

As an instance you purchase $1,000 price of commodities from Firm XYZ in your editions, you require to debit your Buy Account and credit score Firm XYZ. As a result of the supplier, Firm XYZ, is giving items, you’re required to credit score Firm XYZ. Then, you require to debit the receiver, that’s your Buy Account.

2. Debit what arrives in and credit score what courts

For precise accounts, use this golden rule. Actual accounts are additionally known as sturdy accounts. Actual accounts don’t shut at year-end. Fairly, their proportions are carried over to the next accounting interval. An actual account is claimed to be an asset account, an fairness account, or a legal responsibility account. Actual accounts additionally comprise contra belongings, fairness, and legal responsibility accounts. With an actual account, at any time when one thing arrives in your organization (e.g., an asset), debit the account. Additionally, when one thing leaves out of your organization, credit score the account.

Say you obtain furnishings for $2,500 in cash. Debit your Furnishings Account (what arrives in) and credit score your Money Account (what leaves out).

3. Debit bills and losses, credit score revenue and features

The last word golden rule of accounting pacts with nominal accounts. A nominal account is claimed to be an account that you just shut on the finish of every accounting period. Nominal accounts are additionally known as momentary accounts. Nominal or momentary accounts comprise income, achieve, expense and loss accounts. In nominal accounts, debit the account if your organization has a loss or expense. Credit score your account if your organization must doc revenue or achieve.

As an instance you purchase $3,000 of commodities from Firm ABC. To doc the transaction, it is best to debit the expenditure ($3,000 buy) and credit score the income.

As an instance you promote $1,700 commodities to Firm ABC. You need to credit score the income in your Gross sales Account and debit the expenditure.

Why is Common Ledger Essential?

The overall ledger is an in depth report of all financial transactions adjusted for the lifetime of your agency.

The phrase “holding the books” infers to retaining a basic ledger, the primary accounting report on your firm should you use double-entry bookkeeping. It’s the basic device that lets you preserve a hint of all transactions and type them into subcategories so your accountant can find a summarized, complete report of your organization funds multi functional space.

The overall ledger performs an important position in your organization’s monetary operations, appearing as a complete repository. Consider it as a central hub that holds all of the monetary data wanted to arrange your organization’s monetary statements. It’s constructed upon foundational paperwork, with at the least one journal entry corresponding to every monetary transaction. These foundational paperwork might be invoices or cancelled checks, serving as proof of the transactions recorded.

Listed below are six justifications that the overall ledger is so important for your enterprise:

- Mortgage utility: Lenders will constantly ask for a mix of financial data if your organization pertains for a mortgage. Your basic ledger can allow you to immediately find and establish no matter knowledge you want.

- Balancing your books: A basic ledger lets you full a trial stability. This lets you stability the books.

- Prepared for an Audit: If one is audited by the IRS (Inner Income Service), it will likely be easy to formulate the audit since your financial data are multi functional spot.

- Fraud detection: It lets you extra effortlessly place fraud or some other drawback together with your books since it’s easy to look by means of and comprehend.

- Inner and exterior communication: The overall ledger retains all the info important to supply your financial statements for each administration, or inner use and exterior, or investor or client use.

- Tax Compliance and Advantages: The GL ensures that each penny of revenue and expense is accounted for, making tax submitting much less of a headache. Furthermore, it may assist establish potential tax deductions and credit, making certain you are not leaving cash on the desk. Within the realm of enterprise, the place each greenback counts, these tax advantages could make a big distinction in your backside line.

Common Ledger vs Common Journal

The overall journal, also known as the e book of authentic entry, serves as the first step within the accounting course of. Every transaction is recorded in chronological order, offering an in depth narrative of each monetary exercise. This makes the overall journal an important useful resource for anybody in search of perception into particular entries. That is how basic journal entries appear to be –

| Date | Particulars | L.F. | Debit ($) | Credit score ($) |

|---|---|---|---|---|

| 02/01/24 | Workplace Provides – XYZ Model, Account #123456 | 101 | 150.00 | |

| 02/02/24 | Service Income – Contracted Providers, Account #789012 | 102 | 300.00 | |

| 02/03/24 | Hire Expense – Workplace House, Account #345678 | 103 | 800.00 | |

| 02/04/24 | Financial institution Mortgage – ABC Financial institution, Mortgage #987654 | 104 | 5000.00 |

Conversely, the overall ledger, or accounting ledger, is the spine of the accounting system. It is the place the double-entry bookkeeping takes place, with every transaction affecting two accounts: one debit and one credit score. The overall ledger consolidates knowledge from varied journals into related accounts, making it simpler to arrange monetary statements and assess the monetary well being of a enterprise. That is how basic ledger entries appear to be –

| Date | GL Code | Class | Subcategory | Reference | Debit ($) | Credit score ($) | Operating Stability ($) |

|---|---|---|---|---|---|---|---|

| 02/01/24 | 10011 | Belongings | Workplace Provides | INV-001 | 150.00 | 150.00 | |

| 02/02/24 | 40201 | Income | Service Income | SRV-002 | 300.00 | 150.00 | |

| 02/03/24 | 50101 | Bills | Working Bills | RENT-003 | 800.00 | 650.00 | |

| 02/04/24 | 20001 | Liabilities | Loans Payable | LOAN-004 | 5000.00 | 5650.00 |

Key Variations are –

- Performance: The overall journal is the place to begin for all transactions, with every transaction recorded in descriptive chronological type to make sure readability and ease of studying. The overall ledger, nevertheless, is the place these transactions are summarized into non-descriptive structured accounts, facilitating the method of economic assertion preparation.

- Double-Entry Bookkeeping: Whereas the journal data transactions in chronological order with out the need of balancing debits and credit for every entry, the ledger is the place double-entry bookkeeping comes into play, necessitating that each debit has a corresponding credit score.

- Goal and Use: The journal is used for recording the detailed narrative of each transaction, serving as a complete reference. The ledger’s function is to mixture this data, making it simpler to investigate and interpret monetary knowledge at scale.

Find out how to Implement a Common Ledger on your Enterprise

Step one in choosing the proper basic ledger system is a radical evaluation of your enterprise’s measurement and complexity. Whether or not you are operating a small native enterprise or a multinational company, the quantity of transactions and the operational complexity will considerably affect your system necessities. A system that is too primary may not deal with the complexity, whereas an excessively refined system may overwhelm and decelerate processes. It is essential to strike the correct stability, making certain the system aligns with your enterprise’s scale and operational wants.

With this in thoughts, you possibly can discover and discover the correct Common Ledger software program for you based mostly on the options you want. Beneath guidelines covers a broad spectrum of options that companies ought to take into account when evaluating basic ledger programs.

Core Accounting Options

- Chart of Accounts: Customizable accounts for recording transactions.

- Journal Entries: Handbook and computerized entry capabilities.

- Monetary Statements: Technology of stability sheets, revenue statements, and money circulation statements.

- Financial institution Reconciliation: Instruments to match financial institution transactions with GL entries.

- Accounts Payable (AP): Administration of payments and funds to distributors.

- Accounts Receivable (AR): Monitoring of buyer invoices and receipts.

Compliance and Reporting

- Audit Trails: Information of modifications to knowledge for transparency and compliance.

- Tax Administration: Help for varied tax charges and jurisdictions.

- Multi-Forex Help: Dealing with of transactions in a number of currencies.

- Regulatory Compliance: Options to make sure compliance with monetary rules.

Scalability and Flexibility

- Modular Construction: Add-on modules for added performance.

- Customization Choices: Potential to tailor the system to particular enterprise wants.

- Person Entry Administration: Management over person permissions and entry ranges.

- Scalability: Potential to deal with development in transaction quantity and complexity.

Integration and Information Administration

- Third-Get together Integrations: Compatibility with different enterprise software program (CRM, ERP, and many others.).

- Information Import/Export: Instruments for shifting knowledge to and from the system.

- Doc Administration: Storage and retrieval of economic paperwork.

- Backup and Restoration: Mechanisms for knowledge backup and restoration.

Superior Options

- Budgeting and Forecasting: Instruments for setting monetary objectives and predicting outcomes.

- Venture Accounting: Monitoring of financials for particular initiatives.

- Stock Administration: Oversight of inventory ranges, orders, and gross sales.

- Mounted Belongings Administration: Monitoring of firm belongings and depreciation.

Person Expertise and Accessibility

- Dashboard and Analytics: Visible representations of economic knowledge for insights.

- Cellular Entry: Potential to entry the GL system through cell gadgets.

- Person Interface: Ease of use and intuitive navigation.

- Customized Reporting: Instruments to create and customise monetary experiences.

Safety and Reliability

- Information Safety: Encryption and safe knowledge storage.

- Person Authentication: Safe login processes.

- Uptime Ensures: Dedication to system availability.

- Help and Upkeep: Entry to buyer assist and system updates.

Price and Funding

- Preliminary Setup Prices: Bills related to establishing the system.

- Subscription Charges: Ongoing prices for utilizing the software program.

- Customization Prices: Bills for added customization.

- Coaching and Implementation: Prices for coaching workers and implementing the system.

Check out the beneath sources to check the very best Common Ledger Software program out there proper now –

For Small and Medium Companies:

- The Best Accounting Software for Small Businesses in 2024.

- QuickBooks On-line is usually highlighted as the very best total choice, appreciated for its scalability, complete function set, and robust buyer assist. It is appropriate for a variety of small companies.

- Wave is recognized for its value, offering a strong set of basic features for free, making it ideal for startups and very small businesses with straightforward accounting needs.

- FreshBooks stands out for small service-based businesses, offering strong project accounting features, excellent customer support, and ease of use.

- Zoho Books offers great mobile accounting capabilities and is recommended for businesses that prioritize accessibility and integration with other Zoho apps.

For Enterprises:

Best Accounting Software for Enterprise Businesses

For bigger enterprises, wanting into choices that provide superior performance, reminiscent of Oracle NetSuite and Sage, can be helpful. These options usually assist a wider vary of enterprise processes past accounting, reminiscent of ERP, CRM, and e-commerce.

Industry-Specific Needs:

The choice of accounting software can also depend on your specific industry needs. For example,

- FreshBooks is recommended for service-based businesses due to its project management and time tracking features.

- Businesses in retail or manufacturing might look for software with strong inventory management features, such as QuickBooks Online or Zoho Books.

- MARG ERP 9+ Accounting caters to the unique requirements of healthcare companies with features for billing, inventory management, financial reporting, pharmacy inventory management, and patient record tracking.

- Q7 is built specifically for the trucking industry, Q7 offers a full suite of accounting tools including payroll, general ledger, accounts receivable, and accounts payable. It is noted for its strong order management feature, which includes a quotation tool to track and convert quotations to orders.

- Premier Construction Software (formerly Jonas Premier) is ideal for large construction industry businesses with its project management capabilities and real-time cost updates. However, its pricing may be challenging for smaller businesses or startups. At the same time, Sage 100 Contractor is best for construction microbusinesses, offering scalability, digital tools for general ledgers, accounts receivable and payable, and full support for payroll and time tracking. It’s noted for its more affordable pricing and construction-specific functionality.

In conclusion, evaluating the best general ledger software involves

- consideration of your financial scale,

- ensuring required features are present, and

- making sure the software is compatible with the operational processes and compliance demands of your specific industry.

💡

Demos, trials, and reviews play a crucial role in this decision-making process, providing insights and hands-on experience with the software before making a commitment.

Automate your General Ledger

The general ledger is the backbone of your company’s financial records. It is the centralized repository for all financial data, including assets, liabilities, equity, revenue, and expenses. Managing this manually, especially in a digital ledger, is not only time-consuming but also prone to human error. As businesses scale, the volume of transactions increases exponentially, making manual management an unsustainable practice.

The shortcomings are as follows –

- Time-Consuming Data Entry: Manual entry is not just slow; it’s a drain on resources, pulling staff away from more value-added activities.

- Error-Prone Transactions: The human factor introduces a margin for error in data entry, leading to discrepancies that can cascade through financial reporting.

- Inefficient Approval Workflows: Traditional processes often involve cumbersome approval chains that delay payments and complicate cash flow management.

- Cumbersome Books-Close Process: The process of closing books can be laborious and complex, often requiring extensive manual reconciliation and adjustment.

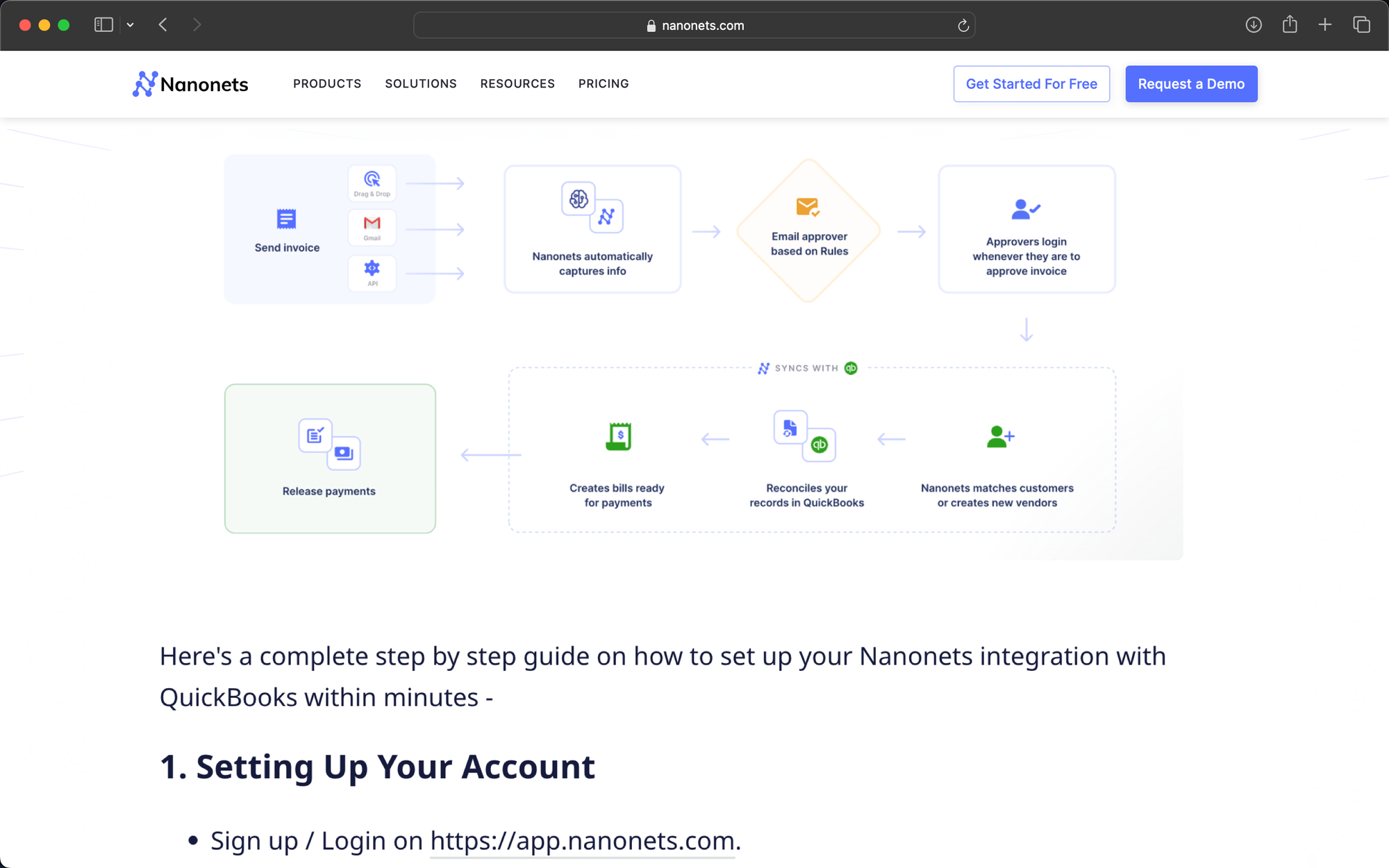

Accounting automation software today alleviates these challenges by employing artificial intelligence and workflow automation. These automation software can work with other accounting systems; many systems have various integration options, such as API or middleware, to provide seamless data transfer between the different systems. This way, automation software can retrieve data such as invoices and purchase orders from other accounting systems, process them and then update the information in the external accounting platform.

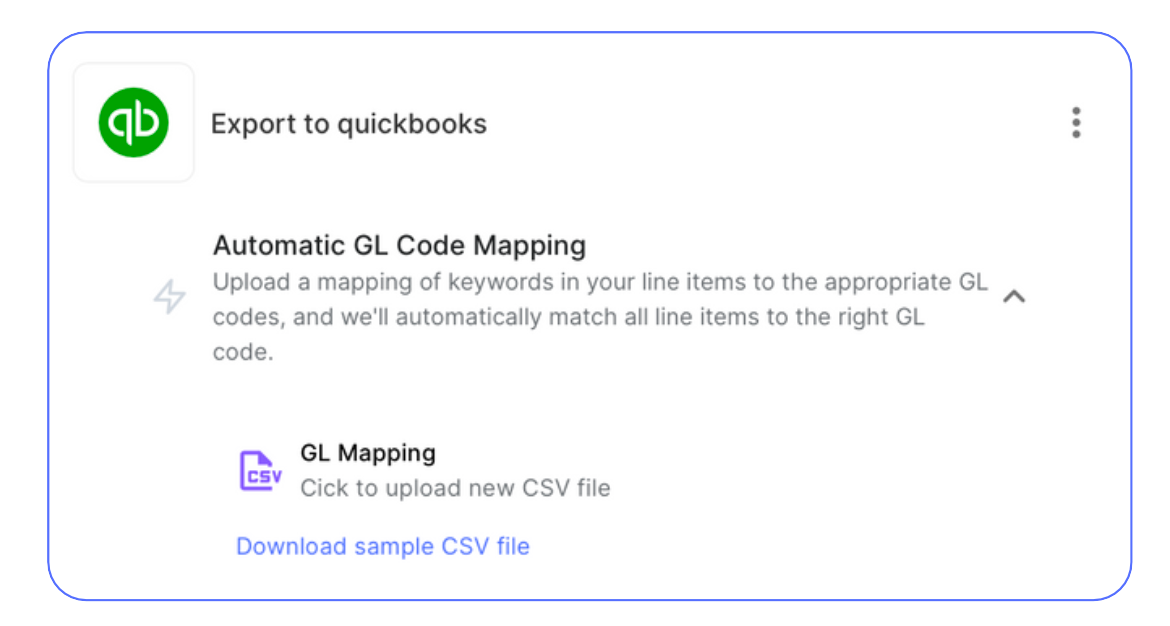

With the integration, businesses can take advantage of the accounting automation software’s capabilities, while still using the accounting software that they are comfortable with. Nanonets’ accounting automation software, for instance, could be built-in with different accounting programs, reminiscent of QuickBooks and Sage.

Let’s examine how automation alleviates the challenges of manually managing your basic ledgers.

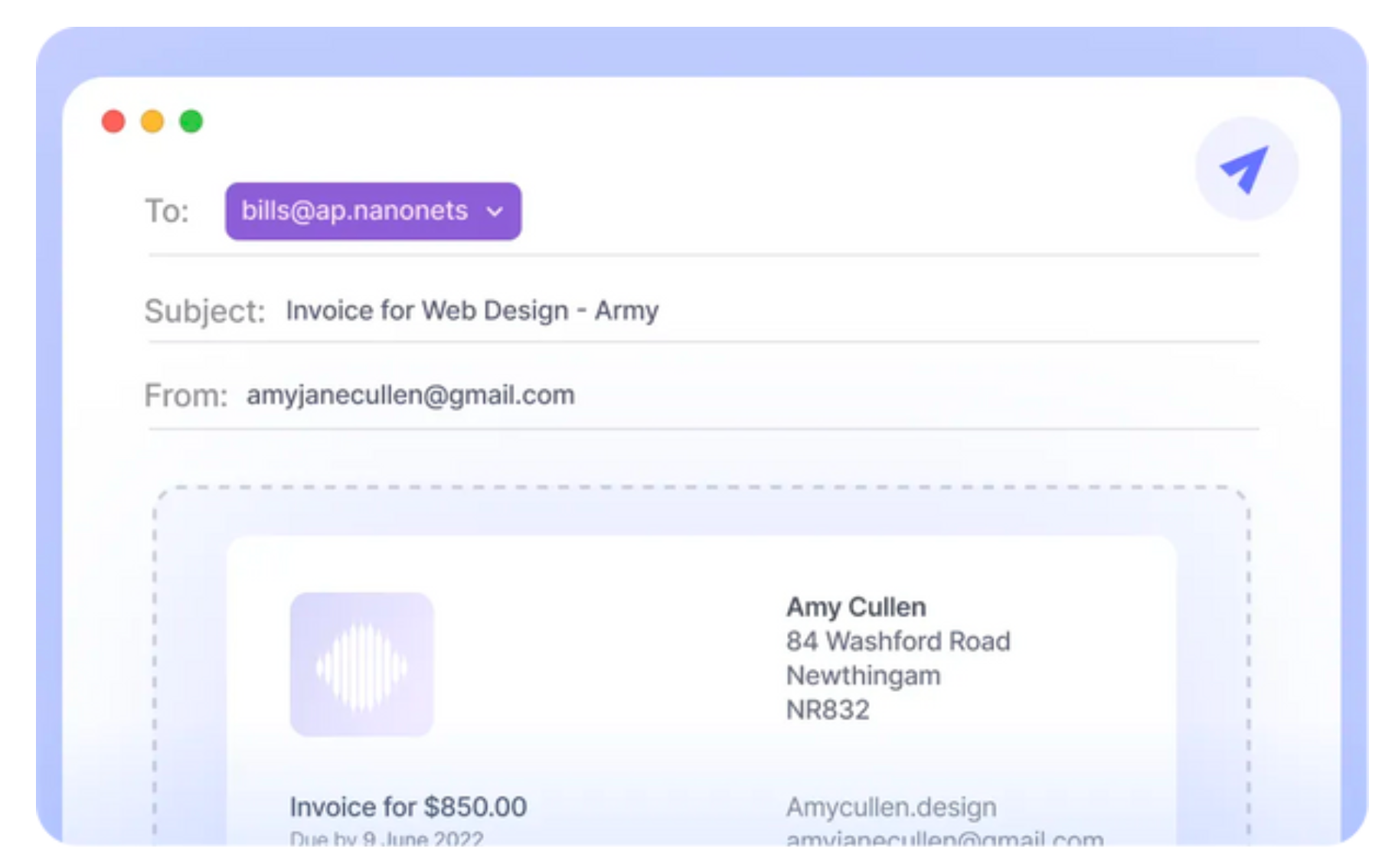

Automated Bill Assortment

Think about a world the place all of your bill and receipt assortment efforts converge harmoniously into one central hub. You may bid farewell to the times of sifting by means of emails, shared drives, vendor portals, and outdated databases. As a substitute, welcome a streamlined vacation spot the place each bill, no matter its origin, is collected mechanically.

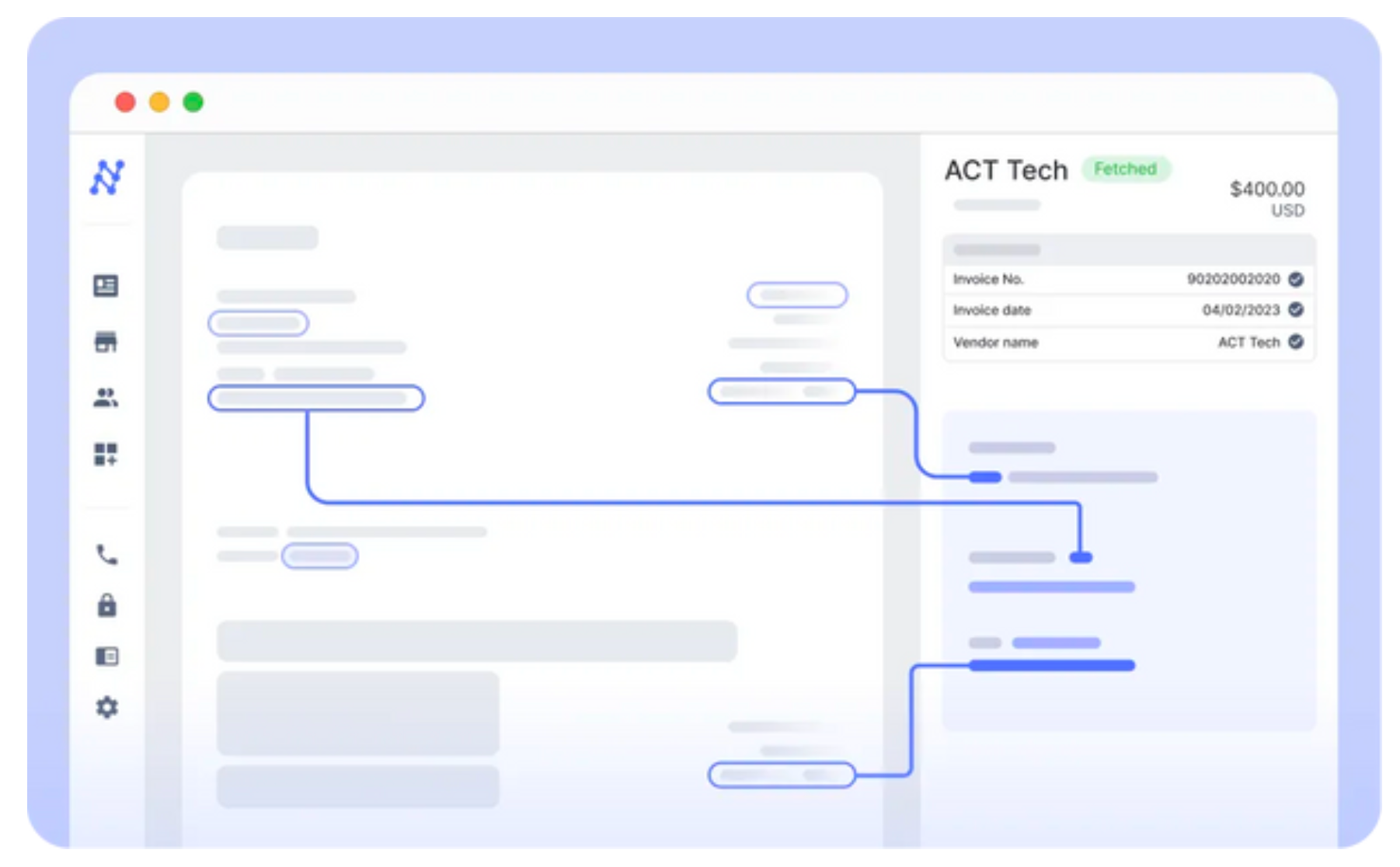

Automated Information Entry

Information entry is usually the bane of effectivity, but it surely would not need to be. Accouting automation software program right now brings to the desk AI-powered Information Extraction that boasts a formidable 99%+ accuracy charge. This implies your invoices, receipts and buy orders are learn and processed with out the painstaking effort of handbook entry. The hours and even days of labor this might save your staff are invaluable. It is the type of change that makes your staff need to come to work within the morning, understanding they’ll concentrate on duties that actually want their experience.

Automated Common Ledger Information Export & Coding

The extracted knowledge is seamlessly exported to your accounting software program’s Common Ledger in real-time. Furthermore, coding these exported GL entries could be extraordinarily tedious and error-prone. Superior AI methods like NLP and LLM are right here to sort out the grunt work. By automating GL coding together with knowledge export, your division can work smarter, not more durable, and make sure the staff’s efforts abilities are used the place they’re most wanted.

Enhancing Accuracy with Automated Verification

The magic of Automated 3-way matching can’t be overstated. Integrating invoices, buy orders, and supply notes reduces each the time spent and the potential for errors—no extra chasing down discrepancies or sending numerous follow-up emails. This method handles the verification course of with such precision that it seems like having an additional set of infallible eyes.

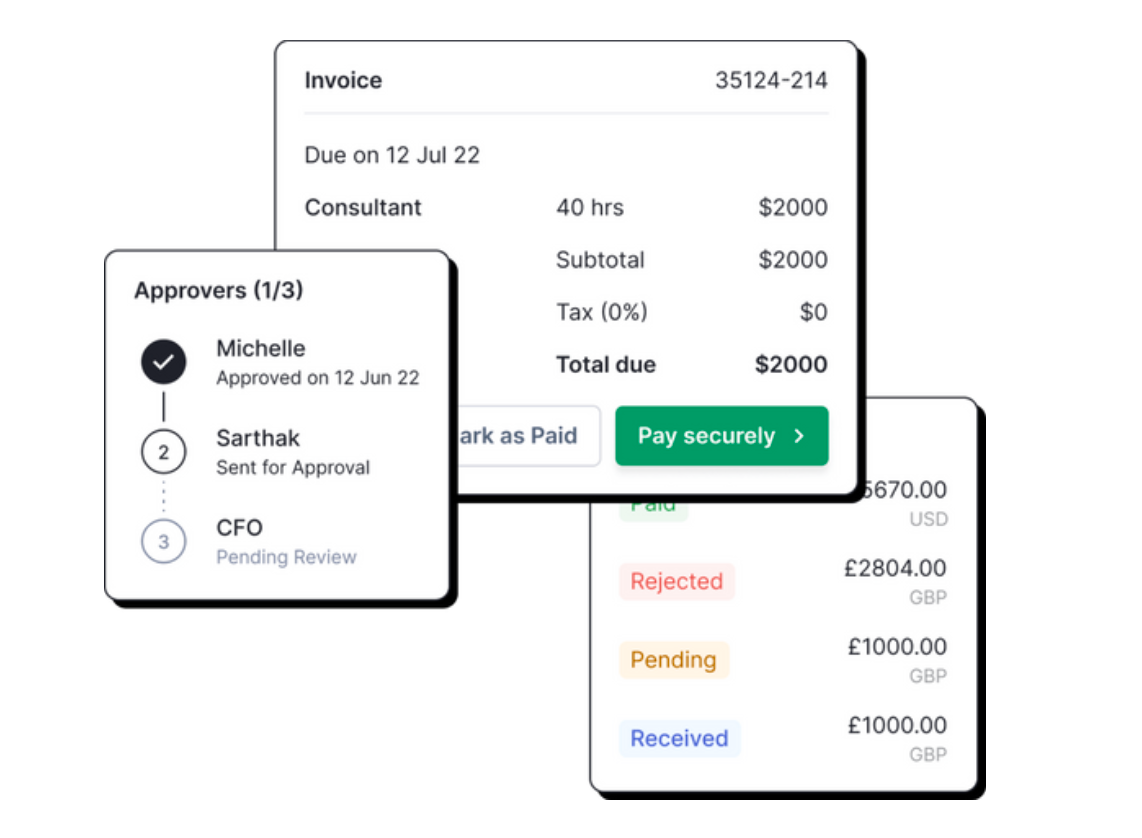

Simplifying Processes with Straightforward Approvals

Workflow automation means approvals are now not a bottleneck. They develop into versatile and stay the place your group does—whether or not that is on electronic mail, Slack, or Groups. This eliminates the necessity for disruptive cellphone calls and the all-too-familiar barrage of reminders. Your approval course of turns into as agile as your staff, adapting to the circulation of your every day operations seamlessly.

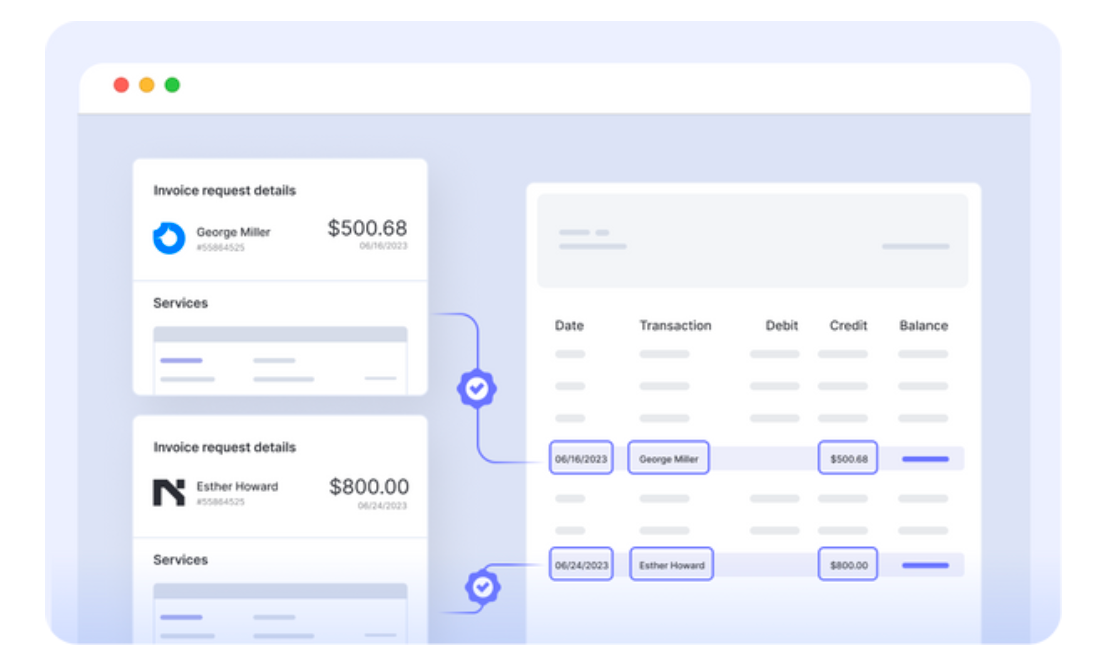

Mastering Funds with Automated Reconciliation

Lastly, let’s discuss closing the books. Automated reconciliation transforms this typically arduous activity, matching financial institution transactions with ledger entries in a fraction of the time it used to take. What as soon as took days can now be completed in minutes. Think about closing your month-to-month books with such pace and precision which you could virtually hear the collective sigh of aid out of your staff.

Nanonets for GL Automation

Integrating Nanonets into your present basic ledger can revolutionize the best way you deal with your GL processes. By leveraging the ability of Nanonets, you possibly can seamlessly automate bill assortment, knowledge entry, knowledge export, coding, verification, approvals, and reconciliation. This not solely saves time but in addition considerably reduces the margin for error, making certain your monetary knowledge is correct and up-to-date.

Join on app.nanonets.com.

Now, you possibly can –

Day 0: Begin a Dialog

Schedule a name at your comfort to debate your wants with our automation consultants, and so they’ll present a personalised Nanonets demo.

Day 1: Assess your Wants

We’ll consider your present accounting course of, pinpoint how Nanonets could make the largest affect, making certain our resolution aligns together with your objectives.

Day 2: Setup and Customization

We’ll information you on utilizing Nanonets. You may arrange & automate your accounting workflow fitted to you based mostly on our dialogue.

Day 3: Testing

After setup, check your workflow with actual knowledge throughout a typical 7-day trial (extendable on request). Our staff will help in fine-tuning your workflow.

Day 7: Buy & Go Reside

After profitable testing, we’ll suggest a tailor-made, cost-effective pricing plan. When you’re proud of it, we’ll go stay!

Ceaselessly: Empowering your Crew

We offer sources, periods, and steady customer support to make sure your staff’s adoption, proficiency and confidence.

Buyer Tales

From small enterprises to multinational companies, these tales showcase the transformative affect of accounting automation with Nanonets throughout industries.

SaltPay: Streamlining Vendor Management with SAP Integration

Trade: Cost Providers and Software program

Location: London, England

Problem: SaltPay confronted the daunting activity of manually dealing with 1000’s of invoices, which was each impractical and inefficient for managing their intensive vendor community.

Answer: Nanonets stepped in with its AI-powered device for bill knowledge extraction, seamlessly integrating with SAP. This integration not solely enhanced knowledge accuracy but in addition considerably improved course of effectivity.

Outcomes: The implementation led to a 99% discount in handbook effort, enabling SaltPay to handle over 100,000 distributors effectively. This drastic enchancment has additionally led to a big enhance in productiveness and automation capabilities.

Tapi: Automating Property Maintenance Invoicing

Trade: Property Upkeep Software program

Location: Wellington, New Zealand

Problem: With over 100,000 month-to-month invoices, Tapi wanted a scalable and environment friendly resolution for bill administration in property upkeep.

Answer: Using Nanonets’ AI device, Tapi automated bill knowledge extraction, facilitating fast integration with present programs that might be maintained by non-technical workers.

Outcomes: The method time was lowered from 6 hours to only 12 seconds per bill, alongside a 70% value saving in invoicing and reaching 94% automation accuracy.

Pro Partners Wealth: Automating Accounting Data Entry in Quickbooks

Trade: Wealth Administration and Accounting

Location: Columbia, Missouri

Problem: Professional Companions Wealth sought to enhance the accuracy and effectivity of information entry for invoicing, as present automation instruments fell brief.

Answer: Nanonets provided a tailor-made resolution with exact knowledge extraction and integration capabilities with QuickBooks, enabling streamlined invoicing and automatic knowledge validation.

Outcomes: The accuracy of information extraction exceeded 95%, with a 40% time saving in comparison with conventional OCR instruments and an over 80% Straight Via Processing charge, minimizing the necessity for handbook intervention.

Augeo: Advancing Accounts Payable Automation on Salesforce

Trade: Accounting and Consulting Providers

Location: United States

Problem: Augeo wanted an environment friendly accounts payable resolution that would combine seamlessly with Salesforce, to handle 1000’s of month-to-month invoices with out the heavy burden of handbook processing.

Answer: Nanonets supplied an AI-driven platform tailor-made for automated bill processing, facilitating straightforward integration with Salesforce for environment friendly knowledge administration.

Outcomes: The answer lowered bill processing time from 4 hours to half-hour every day, achieved an 88% discount in handbook knowledge entry time, and processed 36,000 invoices yearly with heightened accuracy and effectivity.

These buyer tales illustrate the broad applicability and important advantages of accounting automation with Nanonets. By leveraging AI-powered instruments and seamless integrations, corporations should not solely optimizing their GL processes but in addition paving the best way for broader operational excellence. The journey of those organizations underscores the potential of accounting automation to revolutionize monetary operations, driving effectivity, accuracy, and development throughout industries.